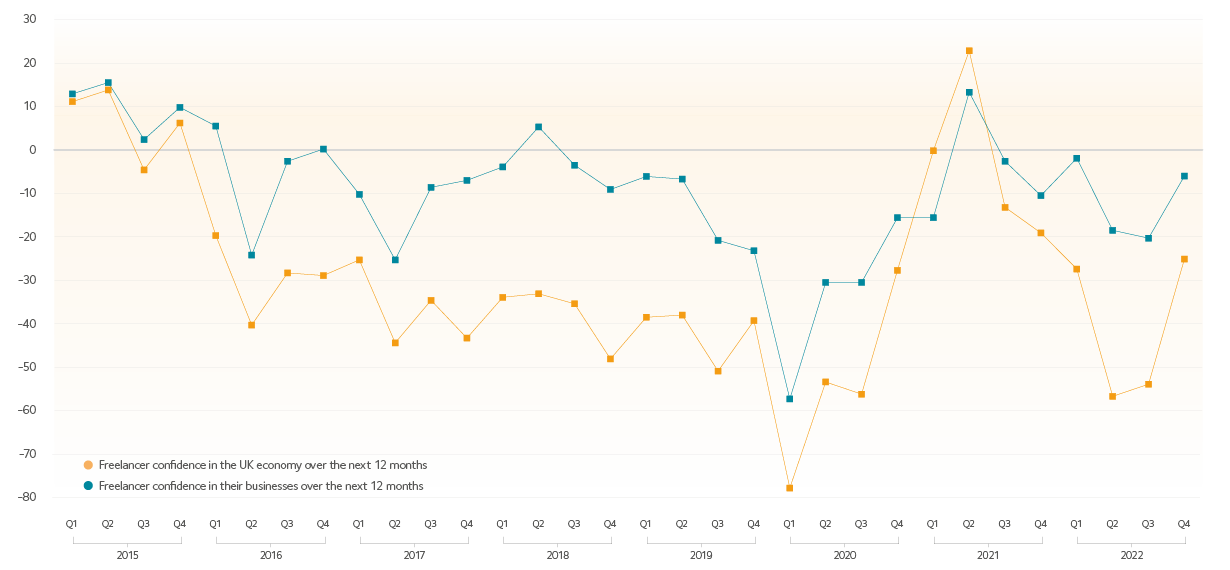

Freelancers’ confidence in their businesses and the UK economy

Table indicates outlook for the next 12 months.

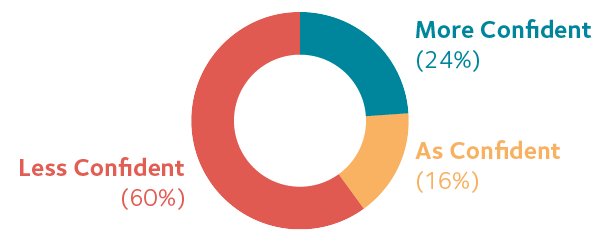

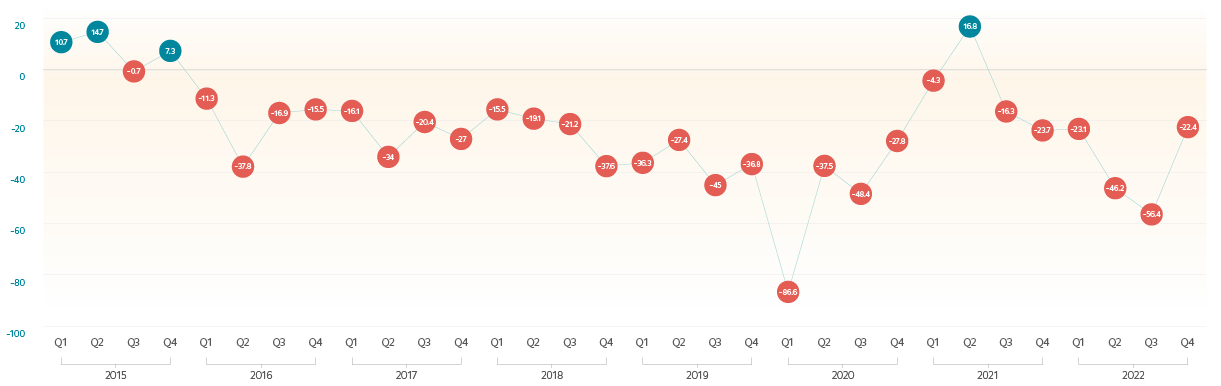

Confidence in the UK economy

for the next 12 months

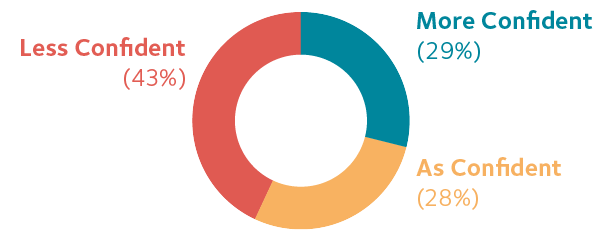

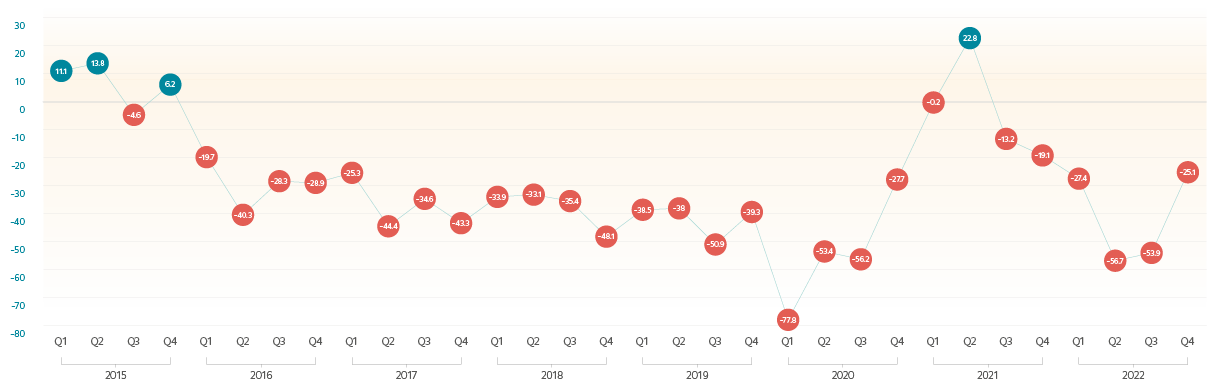

Confidence in their business

for the next 12 months

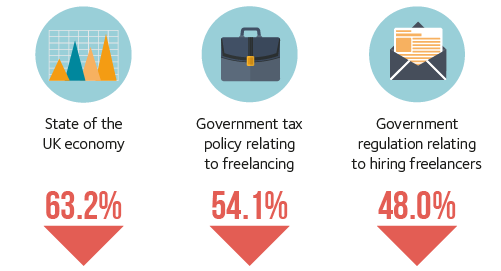

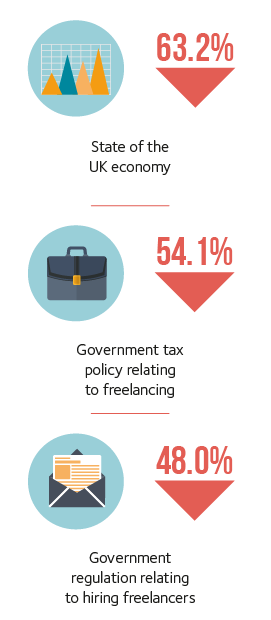

Top factors lowering business

performance in Q4 2022

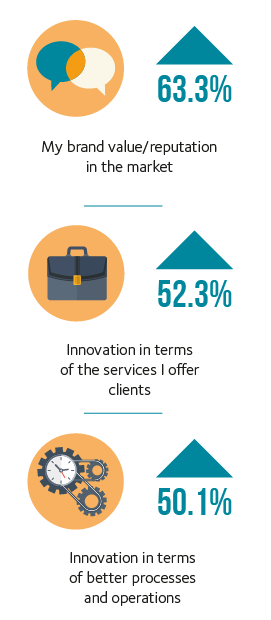

Top factors enhancing business

performance in Q4 2022

Freelancers were asked to rate the importance of 15 different factors affecting the performance of their business in categories ranging from significantly positive and slightly positive, to no impact, slightly negative and significantly negative impact.

Executive Summary

- Freelancers’ confidence in their own businesses for the next three months has increased from -17.7 in Q3 2022 to -8.6 this quarter

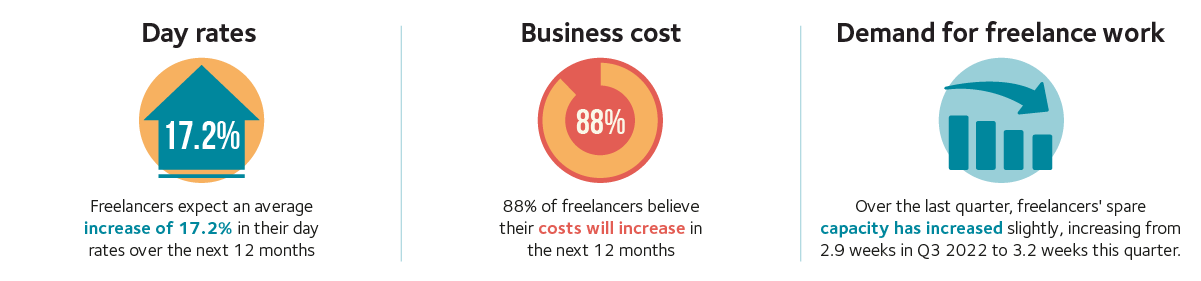

- Almost nine in 10 freelancers (88%) believe that their costs will increase in the next 12 months

- Over the last quarter, freelancers' spare capacity has increased slightly, increasing from 2.9 weeks in Q3 2022 to 3.2 weeks this quarter.

With rising inflationary pressures and an engulfing cost-of-living crisis, it could be expected that freelancers’ confidence in their own businesses would be declining. Instead, freelancers’ confidence in their own businesses for the next three months has reversed this trend and slightly increased from -17.7 in Q3 2022 to -8.6 this quarter.

The index also found that three-fifths of freelancers (60%) were less confident in the state of the UK economy over the next 12 months. Similarly, freelancers' spare capacity has increased slightly since Q3 2022, increasing from 2.9 weeks to 3.2 weeks without work this quarter.

Factors lowering freelancers’ business performance

When analysing the reasons behind the recent fall in freelancer confidence, the FCI revealed that the state of the UK economy (63.2%) was the most detrimental factor impacting self-employed workers.

The other main issues impacting self-employed workers over the past quarter were government tax policy relating to freelancing (54.1%) and government regulation relating to hiring freelancers (48.0%).

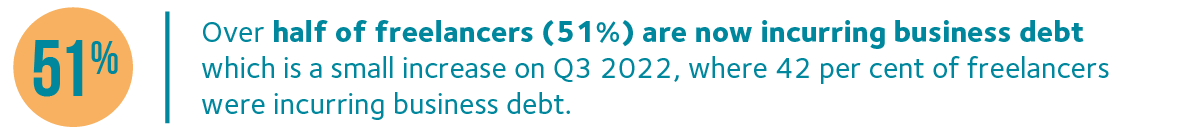

Rising debt and costs

Concerningly, over half of freelancers (51%) are now incurring business debt which is an increase on Q3 2022, where 42 per cent of freelancers were incurring business debt.

Almost one in five freelancers (19%) are now incurring debt via credit cards issued in the name of their self-employed business – slightly up from 18 per cent in Q3 2022.

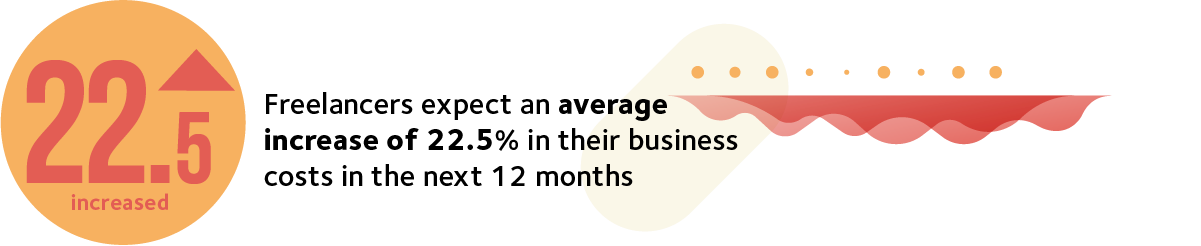

The index also revealed that the majority of freelancers (88%) now expect their business costs to increase over the next 12 months, with freelancers forecasting an average increase of 22.5 per cent in their business costs over the next year.

With rising inflationary pressures and an engulfing cost-of-living crisis, it could be expected that freelancers’ confidence in their own businesses would be declining. Instead, freelancers’ confidence in their own businesses for the next three months has reversed this trend and slightly increased from -17.7 in Q3 2022 to -8.6 this quarter.

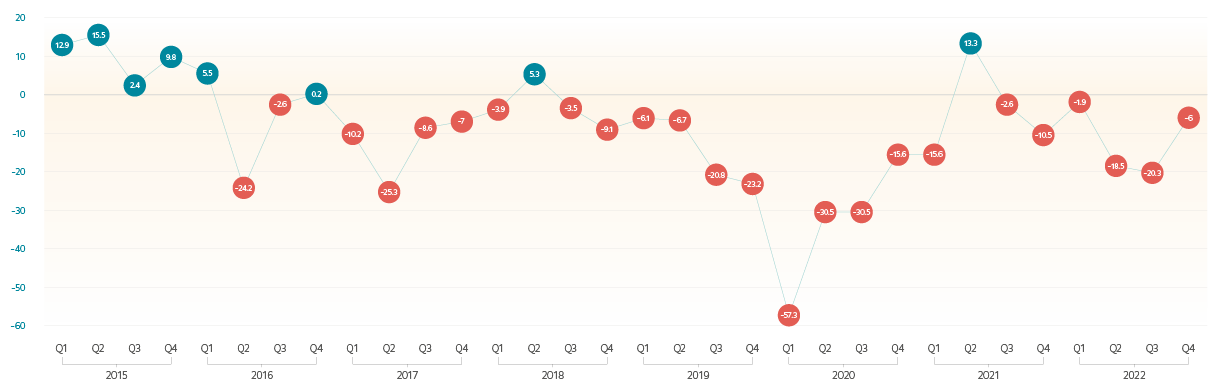

Looking at freelancers’ confidence in their businesses over the next three months in more detail reveals that there were increases in confidence for both SOC1 managerial freelancers and SOC2 professional freelancers. SOC1 managerial freelancers experienced the largest decrease in confidence, increasing from -17.5 in Q3 2022 to 0.6 in Q4 2022, returning to a positive figure for the first time since Q1 2022.

SOC2 professional freelancers reported also reported an increase since last quarter, increasing from -26.9 in Q3 2022 to -12.4 this quarter.

On the other hand, SOC3 associate professional and technical freelancers reported a small decrease in their confidence in their own businesses for the next three months, falling from -9.3 in Q3 2022 to -10.8 in Q4 2022. This now represents the lowest indices score for SOC3 associate professional and technical freelancers since Q3 2020.

Overall, freelancers’ confidence in their own business for the next three months has increased since Q3 2022, although overall confidence remains in negative territory.

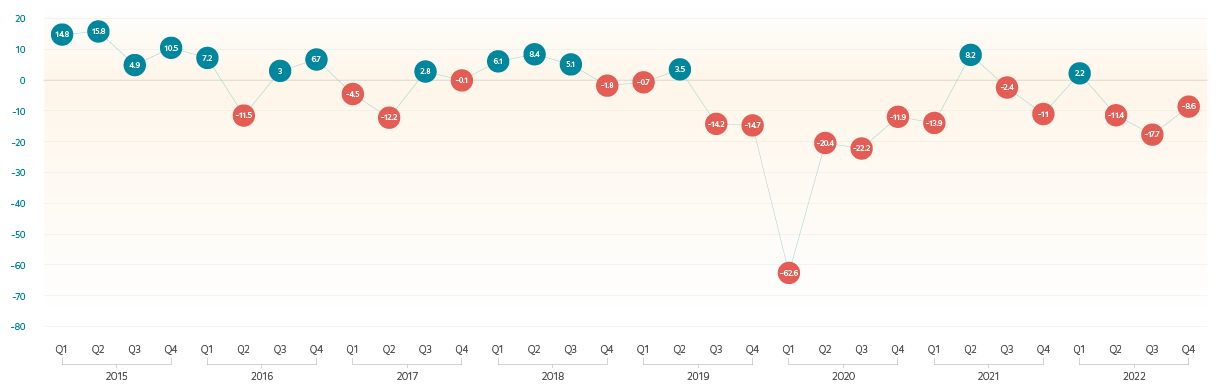

Freelancer confidence indices for their businesses over the next three months

Freelancers were asked to identify their confidence levels for future relative to current performance in one of five categories comprising: more confident, slightly more confident, as confident, slightly less confident, and a lot less confident. The confidence index is created by scoring each of five answers with 100, 50, 0, -50 and -100 respectively and then taking the weighted average score for the sample. The weighted average is based on the relative size of freelancers in the labour market in 2022.

Freelancer business confidence for the next 12 months has increased since Q3 2022, increasing from -20.3 in Q3 2022 to -6.0 in Q4 2022 – driven by increases to all three SOC groups. This represents the highest indices score for business confidence for the next 12 months since Q1 2022.

This quarter, SOC2 professional freelancers reported the largest increase in confidence for the next 12 months, increasing from -36.2 in Q3 2022 to -21.1 this quarter.

Similarly, SOC1 managerial freelancers and SOC3 associate professional and technical freelancers both also reported increases, increasing from -15.0 in Q3 2022 to 6.8 in Q4 2022 and from -36.2 in Q3 2022 to -21.1 this quarter respectively.

Overall, our findings reveal that business confidence for the next 12 months closely aligns with our findings for business confidence for the next three months, with freelancers now slightly more confident in their business compared to last quarter – albeit remaining in negative territory. This is driven by increases in confidence to all three SOC groups.

Freelancer confidence indices for their businesses over the next 12 months

Freelancers were asked to identify their confidence levels for future relative to current performance in one of five categories comprising: more confident, slightly more confident, as confident, slightly less confident, and a lot less confident. The confidence index is created by scoring each of five answers with 100, 50, 0, -50 and -100 respectively and then taking the weighted average score for the sample. The weighted average is based on the relative size of freelancers in the labour market in 2022.

Top factors which lower freelancers’ business performance

Freelancers were asked to rate the importance of 15 factors which can affect the performance of their business in categories from significantly positive, slightly positive, no impact, slightly negative, significantly negative.

We now move on to explore the factors that freelancers identify as having an influence on their business performance. In terms of negative determinants, freelancers have not changed their view regarding their top factor but, interestingly, have changed their view regarding the second and third greatest negative determinants.

This quarter, freelancers continue to cite the state of the UK economy as the top factor negatively affecting freelancers’ business performance, with 63.2 per cent of freelancers citing this factor. This can be largely attributed to the current backdrop of rising inflationary pressures and the engulfing cost-of-living crisis negatively impacting freelance businesses. Perhaps unsurprisingly, all three SOC groups cited the state of the UK economy as the top negative determinant.

Government tax policy relating to freelancing was the second most selected factor for freelancers, with 54.1 per cent of freelancers citing this factor in Q4 2022 and largely driven by SOC2 managerial freelancers citing this as their second greatest factor negatively affecting their business.

Interestingly, government regulation relating to hiring freelancers is now considered the third greatest factor negatively affecting freelance businesses, largely driven by SOC1 managerial freelancers citing this as their second greatest factor negatively affecting their business.

Overall, with macroeconomic factors continuing to impact the self-employed sector, it is perhaps unsurprising that the state of the UK economy continues to be cited as the most detrimental factor for freelance businesses.

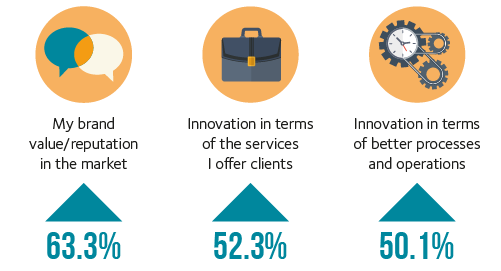

Now looking at the factors which enhance freelancers’ business performance, this quarter reveals that whilst all the negative factors were external, the factors enhancing freelancers’ business performance remain largely internal.

In line with our findings from the last two successive quarters, the top two factors positively enhancing freelancers’ business performance remain unchanged this quarter.

Brand value and reputation in the market continues to be the top factor positively enhancing freelancers’ business performance, with 63.3 per cent of freelancers citing this. This is driven by the fact that all three SOC groups ranked their brand value and reputation in the market as their top enhancing factor.

Innovation in terms of the services offered to clients remains as the second most positively enhancing factor on freelancers’ business performance in Q4 2022, with 52.3 per cent of freelancers citing this factor this quarter.

The third most enhancing factor for freelancers’ business performance this quarter is now innovation in terms of better processes and operations, with 50.1 per cent of freelancers citing this factor this quarter.

Overall, the top two factors enhancing freelancers’ business performance remain unchanged compared to Q3 2022, with freelancers continuing to rely on brand value and reputation in the market to enhance their business performance.

Looking more closely at SOC groups reveals that innovation in terms of services offered to clients was cited by SOC1 managerial freelancers (48.1%) as their second most enhancing factor whilst also selected by SOC2 professional freelancers (48.6%) and SOC3 associate professional and technical freelancers (58.3%) as the third most enhancing determinant.

Interestingly, the adoption of flexible working practices by organisations was cited by SO2 professional freelancers as their second most enhancing factor, with 55.5 per cent of this SOC group determining it as a positive factor on their business performance.

SOC1 managerial freelancers also reported that targeting new markets was their third most enhancing factor, with 45.5 per cent citing this positive determinant.

Top factors which enhance freelancers’ business performance

Freelancers were asked to rate the importance of 15 factors which can affect the performance of their business in categories from significantly positive, slightly positive, no impact, slightly negative, significantly negative.

Following five successive falls in freelancers’ quarterly confidence in the UK economy for the next three months, confidence has now increased for the first time since Q2 2021, increasing from -56.4 in Q3 2022 to -22.4 in Q4 2022.

The increase in confidence is driven by increases in confidence across all SOC groups. Of these, SOC2 professional freelancers reported the largest increase in confidence, increasing from -70.4 in Q3 2022 to -33.7 this quarter.

Similarly, SOC1 managerial freelancers also reported an increase in confidence for the UK economy over the next three months, increasing from -40.5 in Q3 2022 to -6.0 in Q4 2022.

In addition, SOC3 associate professional and technical freelancers experienced a similar increase in confidence, increasing from -53.3 in Q3 2022 to -22.1 in Q4 2022.

Overall, freelancer confidence in the UK economy over the next three months has increased to its highest level since Q3 2021, although remains in negative territory.

Freelancer confidence indices for the UK economy over the next three months

Freelancers were asked to identify their confidence levels for future relative to current performance in one of 5 categories comprising: more confident, slightly more confident, as confident, slightly less confident, and a lot less confident. The confidence index is created by scoring each of five answers with 100, 50, 0, -50 and -100 respectively and then taking the weighted average score for the sample. The weighted average is based on the relative size of freelancers in the labour market in 2022.

Now looking at freelancers’ confidence in the UK economy for the next 12 months reveals an increase in confidence, increasing from -53.9 in Q3 2022 to -25.1 this quarter. This is driven by increases in all three SOC groups.

SOC1 managerial freelancers have reported an increase in their overall confidence for the UK economy over the next 12 months, increasing from -40.5 in Q3 2022 to -4.8 this quarter.

Similarly, SOC2 professional freelancers have also experienced an increase in their overall confidence for the UK economy for the next 12 months, increasing from -74.2 in Q3 2022 to -39.9 in Q4 2022.

In addition, SOC3 associate professional and technical freelancers have experienced an increase in their confidence in the UK economy, increasing from -43.5 in Q3 2022 to -24.0 in Q4 2022.

Overall, freelancers’ confidence in the UK economy for the next 12 months has increased compared to the last quarter, although remains in negative territory.

Freelancer confidence indices for the UK economy over the next 12 months

Freelancers were asked to identify their confidence levels for future relative to current performance in one of five categories comprising: more confident, slightly more confident, as confident, slightly less confident, and a lot less confident. The confidence index is created by scoring each of five answers with 100, 50, 0, -50 and -100 respectively and then taking the weighted average score for the sample. The weighted average is based on the relative size of freelancers in the labour market in 2022.

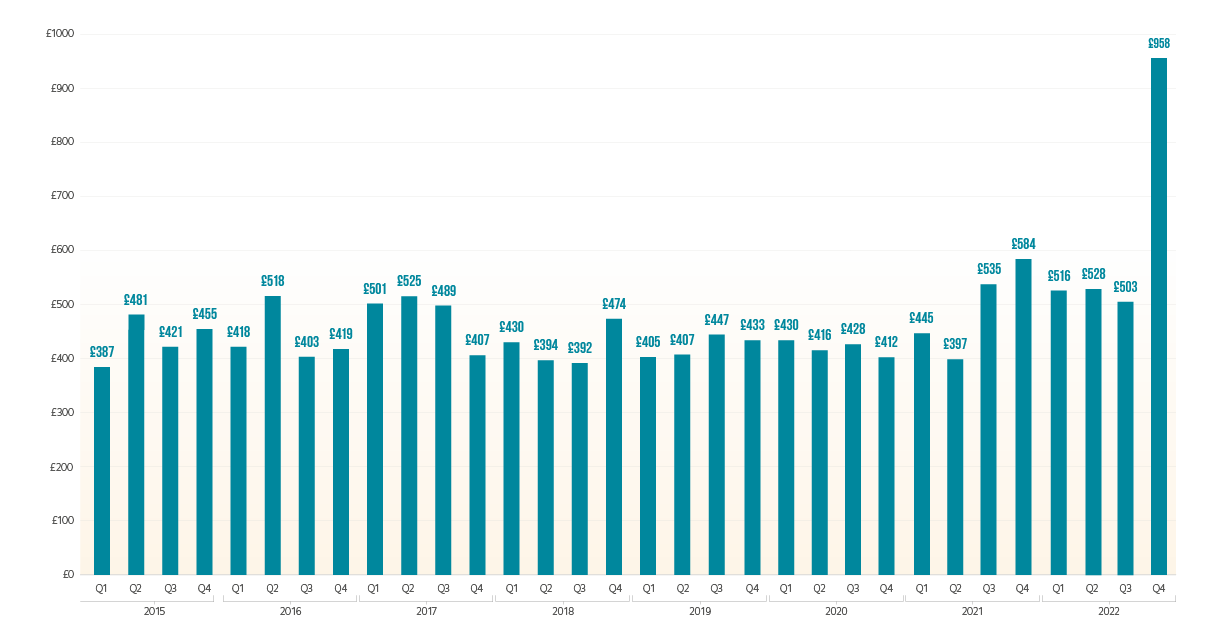

According to our data, day rates have now increased dramatically compared to Q3 2022, with the average day rate charged by freelancers over the last three months standing at £958, increasing from £502 in Q3 2022 and representing a 90 per cent increase since last quarter. This also represents the highest day rate charged by freelancers since the establishment of the confidence index in 2014.

Whilst day rates have understandably increased due to more freelancers operating via an umbrella company and due to cost-of-living pressures, we are surprised by these latest findings on day rates. Anecdotally, both IPSE and PeoplePerHour have heard that this significant increase in day rates doesn't entirely match with what freelancers are seeing in the market, but we are still presenting these findings as it's what was reported to us. We will be looking closely at the findings for Q1 2023 to review whether this appears to be an accurate trend or an anomalous result.

The significant increase in day rates this quarter is driven by sharp rises to all three SOC groups and likely attributed to the current inflationary pressures engulfing the UK.

SOC3 associate professional and technical freelancers have experienced the largest increase to their day rates, increasing from £265 in Q3 2022 to £796 this quarter, an increase of 200 per cent on last quarter.

Similarly, SOC1 managerial freelancers have also experienced a sharp increase in the average day rates charged over the last three months, increasing from £726 in Q3 2022 to £1,259 in Q4 2022 – an increase of 73 per cent since Q3 2022.

In addition, SOC2 professional freelancers report that their average day rates have increased by 53 per cent since last quarter, increasing from £608 in Q3 2022 to £929 in Q4 2022.

Overall, the data now shows that day rates have increased dramatically since Q3 2022, increasing on average by 90 per cent on last quarter and now at a record-high level likely. However, we remain unconvinced about the significant increase in day rates reported and we will be looking closely at the findings for Q1 2023 to review whether this appears to be an accurate trend or an anomalous result.

Average day rates charged by freelancers over the last three months

The weighted average is based on the relative size of freelancers in the labour market in 2022.

In terms of quantifying the expected change in day rates, the majority of freelancers (76%) expect an increase in their average day rates for the next 12 months; in addition to the 90 per cent increase already reported between Q3 2022 and Q4 2022. This compares to 52 per cent of freelancers that forecast an increase in their average day rates in Q3 2022.

The majority of SOC1 managerial freelancers (84%) forecast an increase in their expected day rates for the next 12 months whilst 78 per cent of SOC3 associate professional and technical freelancers expect their day rate to increase in the coming 12 months.

In addition, 68 per cent of SOC2 professional freelancers are forecasting an increase in their day rate over the next year.

Interestingly, when asked to quantify the expected change to their day rates, freelancers now expect their day rates to increase by 17.2 per cent.

Overall, the majority of freelancers now expect their day rates to increase over the next 12 months, in line with concerns around inflationary pressures revealed in our business and economic confidence indices.

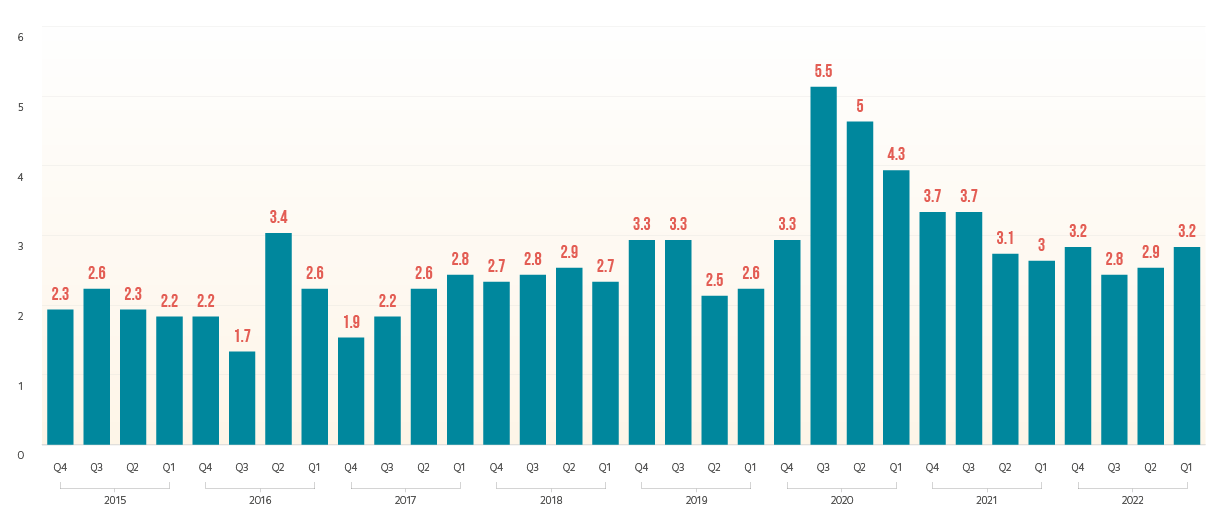

Freelancers’ spare capacity has increased since Q3 2022, increasing from 2.9 weeks without work per quarter in Q3 2022 to 3.2 weeks this quarter.

This increase in freelancers’ spare capacity is largely driven by an increase in the spare capacity of SOC1 managerial freelancers, increasing from 2.3 in Q3 2022 to 3.3 this quarter.

Similarly, SOC3 associate professional and technical freelancers also reported an increase in their number of weeks not working this quarter, with spare capacity increasing from 3.2 weeks in Q3 2022 to 3.7 weeks in Q4 2022.

SOC2 professional freelancers, on the other hand, reported a small decrease in their spare capacity this quarter, decreasing from 2.8 weeks without work in Q3 2022 to 2.6 weeks in Q4 2022.

Overall, freelancers are now working slightly less compared to last quarter, with the average number of weeks without work now standing at 3.2 weeks for Q4 2022.

Freelancers’ spare capacity: Number of weeks not working per quarter

The weighted average is based on the relative size of freelancers in the labour market in 2022.

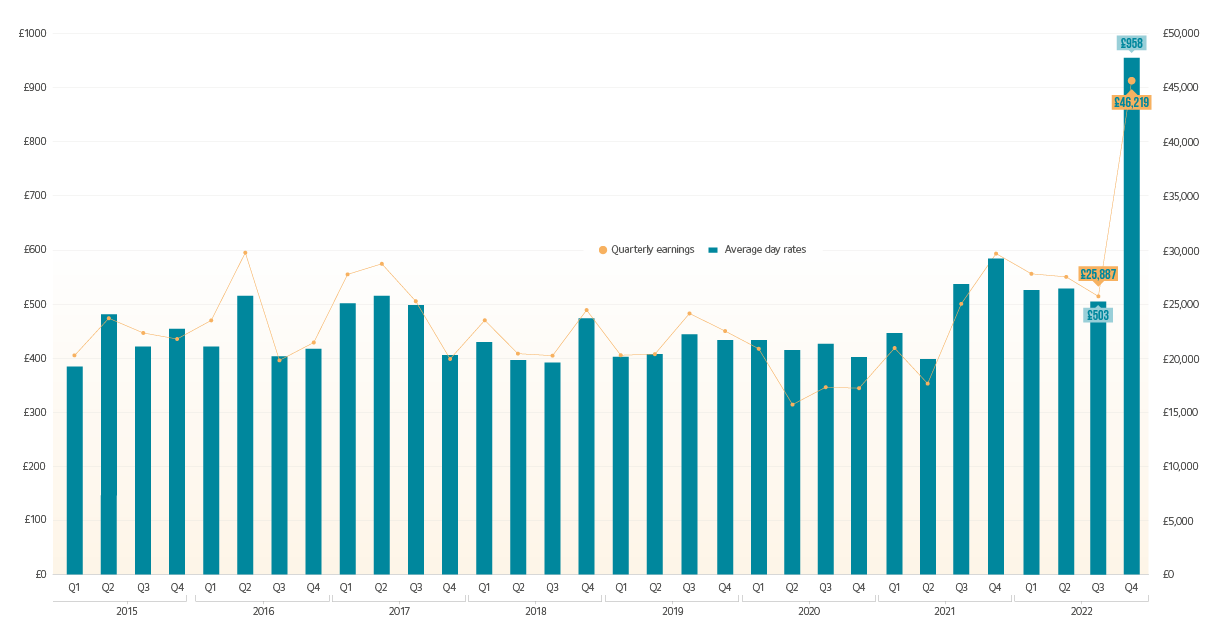

This quarter, freelancers now report a significant increase in their average quarterly earnings – in line with our findings on day rates – increasing from £25,887 in Q3 0222 to £46,219 this quarter.

This is largely driven by SOC3 associate professional and technical freelancers reporting a sharp increase in their quarterly earnings compared to last quarter, increasing from £13,483 in Q3 2022 to £38,971 this quarter.

In addition, SOC2 professional freelancers also experienced an increase in their quarterly earnings, increasing from £30,204 in Q3 2022 to £46,285 in Q4 2022.

Similarly, SOC1 managerial freelancers reported an increase in their average quarterly earnings, increasing from £39,325 in Q3 2022 to £57,720 this quarter.

Overall, average quarterly earnings have increased significantly since Q3 and closely align with our findings on day rates, with all three SOC groups now reporting a dramatic increase in their earnings to cover rising costs as a result of inflationary pressures.

Freelancers’ average quarterly earnings

Employee earnings are based on ONS data on gross weekly earnings by employees. The weighted average is based on the relative size of freelancers in the labour market in the corresponding year. *Employee earnings are based on Office for National Statistics (ONS) data on gross weekly earnings by employees from the provisional 2021 Annual Survey of Hours and Earnings, October 2021 the revised 2020 Annual Survey of Hours and Earnings, October 2021, the revised 2019 Annual Survey of Hours and Earnings, October 2020, the revised 2018 Annual Survey of Hours and Earnings, October 2019, the revised 2017 Annual Survey of Hours and Earnings, October 2018, the revised 2016 Annual Survey of Hours and Earnings, October 2017 and the revised 2015 Annual Survey of Hours and Earnings, October 2016 respectively.

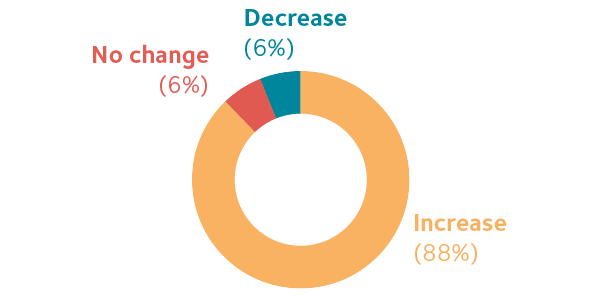

The majority of freelancers (88%) now expect their input costs to increase over the next 12 months which is a slight increase compared to Q3 2022, where 85 per cent of freelancers forecast an increase.

A further 6 per cent of freelancers forecast no change in their input costs for the next 12 months whereas another 6 per cent actually predict a decrease in their input costs for the next 12 months.

In terms of quantifying the expected change in input costs for the next 12 months, freelancers now predict that their input costs will increase by 22.5 per cent.

The majority of SOC3 associate professional and technical freelancers (92%) reported that they expect an increase in their input costs for the next 12 months and forecast an increase of 25 per cent.

Similarly, both SOC1 managerial freelancers (85%) and SOC2 professional freelancers (85%) reported that they expect an increase in their input costs, forecasting increases of 22.6 per cent and 19.7 per cent respectively.

Overall, freelancers are expecting an increase in their business costs for the next 12 months with freelancers expecting current macroeconomic pressures to continue to impact their freelance business.

Freelancer input cost change over the next 12 months

The weighted average is based on the relative size of freelancers in the labour market in 2021.

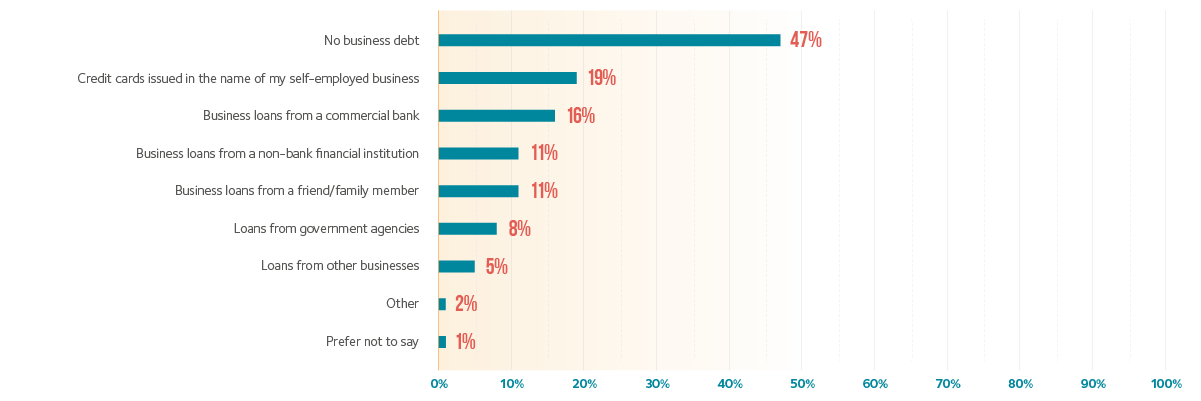

Over half of all freelancers (51%) are now incurring business debt which is an increase on Q3 2022, where 42 per cent of freelancers were incurring business debt.

19 per cent of freelancers are now incurring debt via credit cards issued in the name of their self-employed business (up from 18 per cent in Q3 2022).

A further 16 per cent of freelancers are now incurring debt from a commercial bank which represents a significant increase from our findings in Q3 2022, where just six per cent of freelancers reported that they were incurring debt in this way.

In addition, 11 per cent of freelancers are now incurring debt through business loans from a non-bank financial institution whilst another 11 per cent of freelancers have incurred debt through business loans from a friend or family member (up from 5 per cent in Q3 2022).

A further eight per cent of freelancers are incurring debt through loans from government agencies whilst five per cent are incurring debt through loans from other businesses.

This quarter, just 47 per cent of freelancers reported that they have no business debt which represents a decrease on our findings from Q3 2022, where 55 per cent of freelancers reported that they have no business debt.

Overall, freelancer business debt has increased from last quarter, with freelancers now more likely to be incurring business debt from a commercial bank or through business loans from a friend or family member than in last quarter.

Freelancer business debt

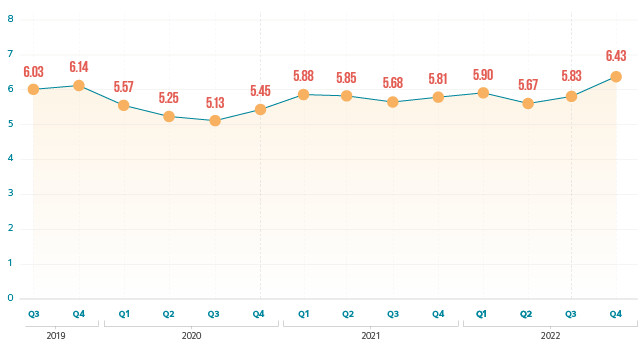

Last quarter, job-related stress levels dropped from 5.70 in Q2 2022 to 5.60 in Q3 2022 (on a 10-point scale where zero is not at all stressed and 10 is extremely stressed).

This quarter, job-related stress levels have increased from 5.60 in Q3 2022 to 6.38 in Q4 2022, driven by increases to all three SOC groups.

SOC1 managerial freelancers have reported the largest increase in job-related stress levels compared to last quarter, increasing from 5.42 in Q3 2022 to 6.95 this quarter.

Similarly, SOC3 associate professional and technical freelancers have experienced an increase in their job-related stress levels since Q3 2022, increasing from 5.84 in Q3 2022 to 6.43 this quarter.

In addition, SOC2 professional freelancers have reported an increase in their job-related stress levels, increasing from 5.47 in Q3 2022 to 5.94 in Q4 2022.

Overall, job-related stress levels have increased since Q3 2022, driven by a sharp increase in stress levels reported by SOC1 managerial freelancers and increases across all three SOC groups.

Job satisfaction has now increased from 5.83 in Q3 2022 to 6.43 this quarter (on a 10-point scale where zero is not at all satisfied and 10 is extremely satisfied).

The increase in job satisfaction is largely driven by an increase in SOC3 associate professional and technical freelancers, increasing from 5.43 in Q3 2022 to 6.72 this quarter.

Similarly, SOC2 professional freelancers also experienced an increase in their job satisfaction compared to last quarter, increasing from 5.86 in Q3 2022 to 6.20 in Q4 2022.

In addition, SOC1 managerial freelancers also reported a small increase in their job satisfaction over the past quarter, increasing from 6.21 in Q3 2022 to 6.29 this quarter.

Overall, freelancers’ job satisfaction has increased from last quarter, driven by increases to all three SOC groups.

With rising inflationary pressures and an engulfing cost-of-living crisis, it could be expected that freelancers’ confidence in their own businesses would be declining. Instead, freelancers’ confidence in their own businesses for the next three months has reversed this trend and slightly increased from -17.7 in Q3 2022 to -8.6 this quarter.

Yet again, the index also found that three-fifths of freelancers (60%) were less confident in the state of the UK economy over the next 12 months.

Despite the data on day rates revealing a dramatic increase in the average day rates charged by freelancers across the last three months, we will be looking closely at the findings for Q1 2023 to review whether this appears to be an accurate trend or an anomalous result. Whilst day rates have understandably increased due to more freelancers operating via an umbrella company and due to cost-of-living pressures, we are surprised by these latest findings on day rates. Anecdotally, both IPSE and PeoplePerHour have heard that this significant increase in day rates doesn't entirely match with what freelancers are seeing in the market, but we have still presented these findings as it's what was reported to us.

Appendix

Find unique insights from our research mini-hubs

Gender equality in the workplace has been widely talked about but very little is known about the experiences of women in self-employment.

This new report with Kingston University looks at the demographic and occupational trends of the solo self-employed sector in the UK in 2019 with a focus on highly skilled freelancers.

We reflect on 2019 and begin to unravel the emerging trends in 2020 - not to mention the devastating effects of Coronavirus on the self-employed community.

In our latest report we aim to uncover who are the disabled self-employed, what are their motivations for entering self-employment, what are the key challenges they face and how can we better support them.