Reviewing barriers to financial products for the self-employed

Our research reviews the barriers to accessing mortgages, private finance and pesions whilst self-employed.

Introduction

A new research collaboration between IPSE and CMME will examine the impact of macroeconomic factors on the financial decision-making of the self-employed, reviewing barriers to accessing mortgages and private finance whilst also evaluating attitudes towards saving for later life.

From previous research carried out between IPSE and CMME in both 2021 and 2022, we already know that self-employed individuals have concerns around their self-employed status and what this means for accessing financial products such as mortgages and their ability to save for later life.[1]

In fact, these findings revealed that three in ten freelancers (30%) had been concerned by their inability to access loans or mortgages due to their employment status whilst the majority of freelancers (71%) were also concerned about saving for later life.[2]

Similarly, the research also revealed that half of all freelancers (50%) planning to purchase a property thought they would be treated unfairly by mortgage lenders.[3]

This report will build on the previous research collaborations to examine the impact of macroeconomic factors on the financial decisions of the UK’s self-employed workforce.

In particular, the report will focus on the impact of rising interest rates and it’s influence on prospective self-employed mortgage applicants, at a time when the number of mortgages approved for house purchases fell at the end of 2022 to its lowest level since the 2008 financial crisis.[4]

The report will also assess current barriers to accessing a mortgage, concerns from those currently on a fixed-term mortgage deal whilst also looking at savings for later life; reviewing why the self-employed continue to be disproportionately less likely to save into a pension.5 Indeed, previous research from IPSE has revealed that just 31 per cent of freelancers were saving into a pension.6

This report then concludes with a series of recommendations for both industry and government to better support access to financial products for the self-employed.

Pension provision for the self-employed

We know from previous IPSE research that the self-employed are disproportionately less likely to save into a pension7, with just 31 per cent of freelancers doing so in 2019.[8]

We therefore wanted to understand the barriers that prevent self-employed individuals from saving into a pension whilst also updating our understanding on how many freelancers are currently contributing to one, and the percentage amount of their annual income they save.

Just over half of our sample (53%) reported that they have a pension and regularly pay into it, whereas a further 30 per cent said that whilst they have a pension, they are not currently paying into it.

Concerningly, 15 per cent of respondents indicated that they don’t currently have a private or personal pension.

Taken together, this accounts for 45 per cent of freelancers that are not currently saving into a pension.

On average, freelancers that are saving towards a pension are contributing 19 per cent of their annual income towards a pension. This is likely attributed to the fact that the average age of the solo self-employed workforce is 49 years old9 and those approaching retirement are contributing higher percentages of their income – benefiting from a greater tax advantage than if they were to pay income tax on those earnings.

In fact, 35 per cent indicated that they are currently contributing 20 per cent or more of their annual income towards a pension.

Looking at the reasons behind those not currently saving into a pension reveals that the top reason was having other financial priorities (34%).

Other reasons cited for a lack of saving into a pension include not being able to afford it (24%) and ceasing contributions to a pension after moving across to self-employment (24%).

Other barriers to saving into a pension reported included reaching the maximum tax-free limit and not being able to keep an existing provider when taking on a new role; especially when operating through an umbrella company.

“Provider changed and I have struggled to sort it out.”

“Reached maximum tax-free limit, it would be of negligible benefit to save more.”

“Have broken the Lifetime Allowance.”

Interestingly, just three per cent of the sample reported that they don’t use any savings products – indicating that the majority of freelancers are saving into savings products other than pensions. It is therefore evident that pension products need to be more tailored to the self-employed, offering greater flexibility for those choosing to work for themselves.

Homeownership

Almost two-fifths of freelancers (38%) reported that they are a homeowner and have a mortgage.

Interestingly, men and limited company directors were slightly more likely to report that they owned a home with a mortgage compared to women and sole traders (41% compared to 30% and 48% compared to 29% respectively).

This closely aligns with our findings from our report in 2021, where those operating through a limited company were more likely to own a property with a mortgage compared to sole traders (55% compared to 35%).[10]

Predictably, freelancers aged over 40 (41%) were also more likely to own property and have a mortgage than freelancers aged under 40 (19%) whilst freelancers charging more than £600 a day were also more likely than those charging less than £600 a day to own property and have a mortgage (56% compared to 38%).

A further three in ten freelancers (31%) reported that they were homeowners but do not have a mortgage, with limited company directors slightly more likely than sole traders to own property without a mortgage (34% compared to 24%).

In addition, freelancers aged over 40 were only slightly more likely to own a property without a mortgage than those aged under 40 (30% compared to 20%) whilst freelancers with a day rate of more than £600 were also more likely than their self-employed counterparts charging less than £600 (51% compared to 23%).

One in ten freelancers (10%) were looking to buy in the next year whilst a further 12 per cent reported that they were planning to buy in the next one to five years.

Perhaps unsurprisingly given that limited company directors were more likely to already own property, sole traders (22%) were more likely to be planning to buy in the next one to five years compared to their self-employed counterparts operating through a limited company (5%).

Female freelancers – also less likely to already own property – were similarly more likely than their male counterparts to be planning to buy property in the next one to five years (21% compared to 9%).

Just seven per cent of respondents were not currently a homeowner and had no plans to buy over the next five years.

Notably, looking across the breakdown by business structure reveals sole traders (19%) were significantly more likely to report that they had no property of their own and no plans to buy in the next one to five years than limited company directors (5%).

Likewise, freelancers aged under 40 were more likely to report they planned to buy in the next one to five years and had no property compared to freelancers aged over 40 (15% compared to 6%).

Freelancers charging more than £600 a day (17%) were only slightly more likely to be looking to buy property in the next one to five years than those charging less than £600 a day (13%).

When asked whether they were self-employed in some capacity at the time of purchasing their property, encouragingly, almost four in five freelancers (75%) had been self-employed at the time of their purchase.

However, under a fifth of respondents (16%) had purchased a property in the last 12 months – likely linked to the impact of rising inflationary pressures and an overall downturn in the mortgage market over the past year.

Impact of macroeconomic factors on upcoming financial decisions

Of those homeowners with a mortgage, almost two-fifths of these (37%) reported that their fixed-rate period ends before 2024 whilst 41 per cent reported that their fixed-rate period ran until after 2024.

A further 20 per cent of those homeowners with a mortgage reported that they were not on a fixed-rate mortgage deal.

In order to understand how those on fixed-rate mortgages have been impacted by macroeconomic factors, we asked how concerned they were about the impact of various external factors when considering the ending of their fixed-rate period. As a result, we’ve been able to ascertain the degree of concern caused by these macroeconomic factors and ultimately reflect the need for greater support for those approaching the conclusion of their fixed-rate period in our recommendations for both industry and government.

As well as reviewing the impact of macroeconomic factors on those with fixed-rate mortgages, we also wanted to understand the impact of the external factors on those freelancers without a fixed-rate mortgage. In order to assess the impact of the macroeconomic factors on those not currently on a fixed-rate mortgage, we asked respondents to rank their level of concern based on their upcoming financial decisions.

The impact of rising interest rates

Interest rates have risen considerably since 2021, with the Bank of England’s Monetary Policy Committee implementing 12 straight rate increases since December 2021.[11] As a result,interest rates have now reached 4.5 per cent by the middle of 2023, representing its highest level since the 2008 financial crisis.12 It is estimated that the increase in interest rates in February 2023 – from 3.5 per cent to four per cent – added nearly £50 to average borrower’s mortgage payments.[13]

With the Bank of England’s base rate influencing the interest rate charged by many lenders for mortgages and rising inflation showing no signs of slowing down, the increasing likelihood of further increases to interest rates is causing concern for many approaching the ending of their fixed-rate period.

Concerningly, over four in five of those on fixed-rate mortgages (84%) reported that they were either somewhat or very concerned about the impact of rising interest rates when thinking about the conclusion of their fixed-rate period.

Almost half (49%) stated that they were very concerned about the impact of rising interest rates.

Notably, when thinking about the ending of their fixed-rate period, just six per cent indicated that they were not very or not at all concerned about the impact of rising interest rates.

A further 10 per cent were neutral about the potential impact of rising interest rates.

Looking at those freelancers without a fixed-rate mortgage reveals that over three-fifths (65%) were either somewhat or very concerned about the impact of rising interest rates on their upcoming financial decisions.

Two-fifths of freelancers without a fixed-rate mortgage (40%) indicated that they were concerned about the impact of rising interest rates on their future financial decisions.

On the other hand, over a quarter (26%) reported that they that they were either not very or not at all concerned when considering their upcoming financial decisions.

A further nine per cent reported that they were neutral towards the impact of rising interest rates.

Overall, it is evident that rising interest rates are significantly impacting freelancers’ upcoming financial decisions. In particular, it represents a major concern for many of those approaching the end of their fixed-rate mortgage. As a result, both industry and government should seek to provide more support, advice and options to those worried about higher mortgage premiums.

The impact of rising inflation

Inflation has steadily been increasing since early 2021, reaching a high of 11.1 per cent in October 2022, affecting the affordability of goods and services for households across the UK.[14]

Rising inflation not only reduces what households can afford to spend, it also causes the Bank of England to push up interest rates – ultimately increasing the interest charged by mortgage lenders and particularly concerning for those approaching the end of their fixed-rate period.

Our research now reveals that the majority of those on fixed-rate mortgages (77%) are either somewhat or very concerned about the impact of rising inflation when considering their fixed-rate period ending – closely aligning with our findings for the impact of rising interest rates.

Almost half of respondents (46%) reported that they were very concerned about the impact of the cost-of-living crisis whereas six per cent indicated that they were either not at all or not very concerned.

An additional eight per cent of freelancers on a fixed-rate mortgage stated that they were neutral about the potential impact.

Now looking at how the squeeze on households is impacting freelancers’ forthcoming financial decisions, of those without a fixed-term mortgage, 68 per cent reported that they were either somewhat or very concerned.

Three in ten respondents (32%) reported that they were very concerned about the cost-of-living crisis when thinking about their upcoming financial decisions.

A further 18 per cent were neutral when asked about the potential impact on their financial decisions.

Much like our findings on the impact of rising inflation and rising interest rates, freelancers approaching the end of their fixed-rate mortgage reported that they were more concerned about the cost-of-living crisis than those not on fixed-rate mortgages.

The state of the UK housing market

Average UK house prices have increased by 13.6 per cent between August 2021 and August 2022, pricing some prospective buyers out of the market whilst increasing asset wealth for those with property.[17]

Looking at our research now reveals that almost three-fifths of freelancers (59%) on a fixed-rate mortgage were either somewhat or very concerned about the state of the UK housing market when considering the conclusion of their fixed-rate period.

A fifth (20%) indicated that they were very concerned about the state of the UK housing market whereas 14 per cent reported that they were either not very or not at all concerned.

A further 27 per cent of respondents on a fixed-term mortgage reported that they were neutral about the potential impact when their fixed-rate period ends.

The volatility of the mortgage market

In order to understand the specific concerns of freelancers without fixed-rate mortgages, we asked these freelancers whether the volatility of the mortgage market would impact their upcoming financial decisions.

Interestingly, 55 per cent of those without fixed-rate mortgages were either somewhat or very concerned about the volatility of the mortgage market when considering their future financial decisions.

A quarter of respondents (25%) indicated that they were very concerned about the volatility of the mortgage market whereas almost one in five (19%) reported that they were either not very or not at all concerned.

An additional 16 per cent of freelancers without a fixed-rate mortgage were neutral about the volatility of the mortgage market when considering their upcoming financial decisions.

The impact of rising house prices

In order to understand the specific concerns of freelancers without fixed-rate mortgages, we also asked these individuals about whether the impact of rising house prices would impact their upcoming financial decisions.

Over three-fifths of freelancers (63%) indicated that they were either somewhat or very concerned by the impact of rising house prices on their forthcoming financial decisions, with 40 per cent reporting that they were very concerned.

A further 20 per cent indicated that they were either not very or not at all concerned whilst 16 per cent were neutral at the potential impact when considering their upcoming financial decisions.

Experiences obtaining a mortgage

A total of 38 per cent of the sample reported that they owned a home with a mortgage and of these, 75 per cent were self-employed at the time of applying for and obtaining their mortgage.

We know from previous research that over half of the self-employed (52%) believe that mortgage providers do not want the self-employed as customers and that mortgage advisors at banks and building societies do not understand the financial situation of the self-employed.[18]

In contrast to this perception, the current research shows that, of those who had obtained a mortgage whilst they were self-employed, over half (55%) had found the process somewhat or very easy. Interestingly, this closely aligns with our research findings from 2021 where 56 per cent reported that the process was either somewhat or very easy.[19]

On the other hand, almost a quarter (23%) stated that they did find the process either somewhat or very difficult.

The most cited reason why some found it difficult, shared by almost all those who had struggled, was having to provide additional paperwork because of their self-employed status (88%). Concerningly, this represents a slight increase on our findings from 2021, where 81 per cent cited this as a factor.

In addition, over three-fifths of respondents (62%) believed that lenders wouldn’t consider them because of their self-employed status which represents a small decrease in our findings from 2021 (67%).

Almost two in five (38%) believed that they were penalised for being self-employed which is also slightly lower than our previous findings (52%).

Worryingly, 23 per cent continue to cite the process as being confusing which closely echoes our findings from 2021 (16%) and highlights the need for further action from industry in this area.

A further 19 per cent indicated that the lender wasn’t willing to lend them the amount they needed whilst 15 per cent stated that there was a lack of low-deposit mortgages on offer.

Additionally, over one in ten (12%) felt they had a lack of support from their lender or broker whilst eight per cent indicated that the rates were higher than they wanted.

Notably, just four per cent of respondents reported that they did not encounter any difficulties when applying for a mortgage.

Which of the following difficulties, if any, did you experience when applying for a mortgage?

Barriers to mortgages for the self-employed

Notably, when we asked those planning to buy property in the next five years how they felt about their chances of accessing mortgage lending as a self-employed individual, over half of these (56%) reported that they were either somewhat or very concerned. In fact, one in three (30%) were very concerned.

On the other hand, 27 per cent reported that they were either not very or not at all concerned about being able to access mortgage lending whilst a further 15 per cent were neutral.

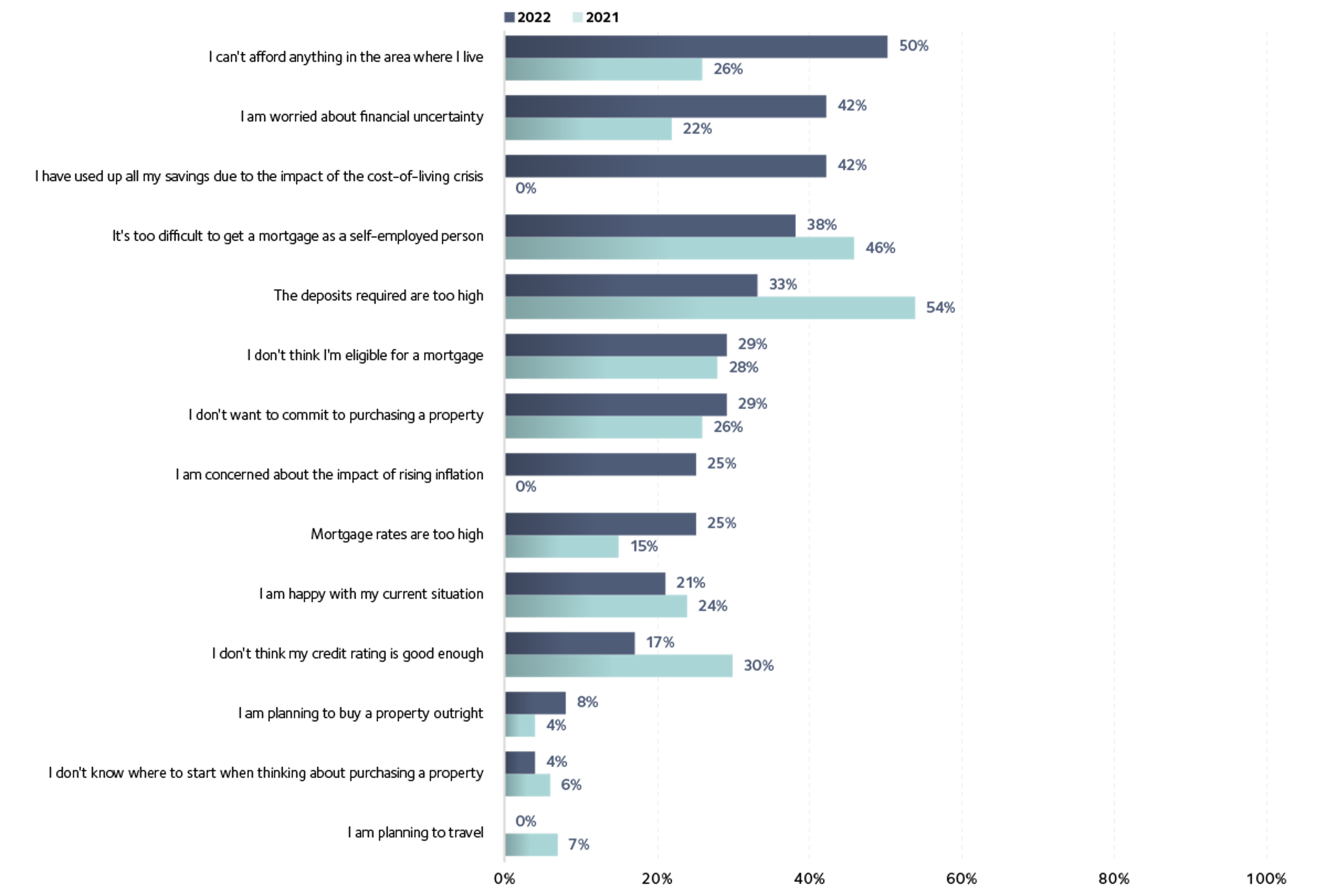

Now looking at those without property but not looking to buy in the next five years, the top reason for not wanting to purchase a property was not being able to afford anything in the area they live (50%). This represents a significant increase on our 2021 findings (26%) and likely linked to the rise in house prices across the UK since 2021.

Concerningly, over two in five (42%) cited the fact that they had used up all their savings due to the impact of the cost-of-living crisis.

A further 42 per cent reported that they were worried about financial uncertainty which represents an increase on our previous research from 2021 (22%) whilst over three in ten (33%) cited deposits as being too high.

Other reasons for not wanting to purchase a property include not thinking their eligible for a mortgage (29%), not wanting to commit to purchasing a property (29%), mortgage rates being too high (25%) and being concerned about the impact of rising inflation (25%).

What are the main reasons you are not planning to get a mortgage in the next five years?

In order to understand other potential barriers to obtaining a mortgage for the self-employed, we asked freelancers planning to buy in the next five years whether they agreed or disagreed with a series of statements related to the process of getting a mortgage.

When asked about whether they understand the steps they need to take in order to get a mortgage, promisingly, over half of respondents (54%) either somewhat or strongly agreed. In fact, 28 per cent strongly agreed that they understand the steps involved in order to secure a mortgage which represents a small increase on our report from 2021 (22%); testament to the progress that has been made by many in the industry in supporting the sector with advice and support.

However, it is evident that further work is still required as 33 per cent continue to report that they either somewhat or strongly disagree about understanding the steps involved.

An additional 12 per cent neither agreed nor disagreed.

When asked about whether they worry if they can afford to get a mortgage, over two in five (43%) of those planning to buy in the next five years either somewhat or strongly agreed that they worry about not being able to afford it.

A quarter (26%), on the other hand, either somewhat or strongly disagreed whilst a further 29 per cent were neutral.

Similarly, when asked about job security, over half (55%) of those planning to buy in the next five years were worried about not having enough job security to get a mortgage, with 17 per cent very concerned. Interestingly, this represents a decrease on our report from 2021, where 34 per cent of those planning to buy in the next five years were concerned about job security.

However, one in five (20%) disagreed with the statement and were not concerned about job security affecting their ability to get a mortgage whilst a further 22 per cent were neutral.

Now looking at concerns around employment status, over half (56%) were worried that it would be difficult to obtain a mortgage due to their employment status, with 27 per cent of these very concerned.

On the other hand, 26 per cent were not worried about the process being difficult due to their employment status whilst an additional 17 per cent were neutral.

Concerningly, when asked about whether they believed lenders would treat them fairly, 42 per cent of those looking to buy in the next five years thought they would be treated unfairly.

An additional 23 per cent were neutral when asked about their employment status being a concern in securing a mortgage.

Credit rating proved a more even split for prospective buyers, with 33 per cent concerned that their credit rating won't be good enough to get a mortgage whereas 31 per cent indicated that it wasn’t a concern for them.

A further 31 per cent were neutral about their credit rating potentially preventing them from obtaining a mortgage.

Areas for further support for the sector

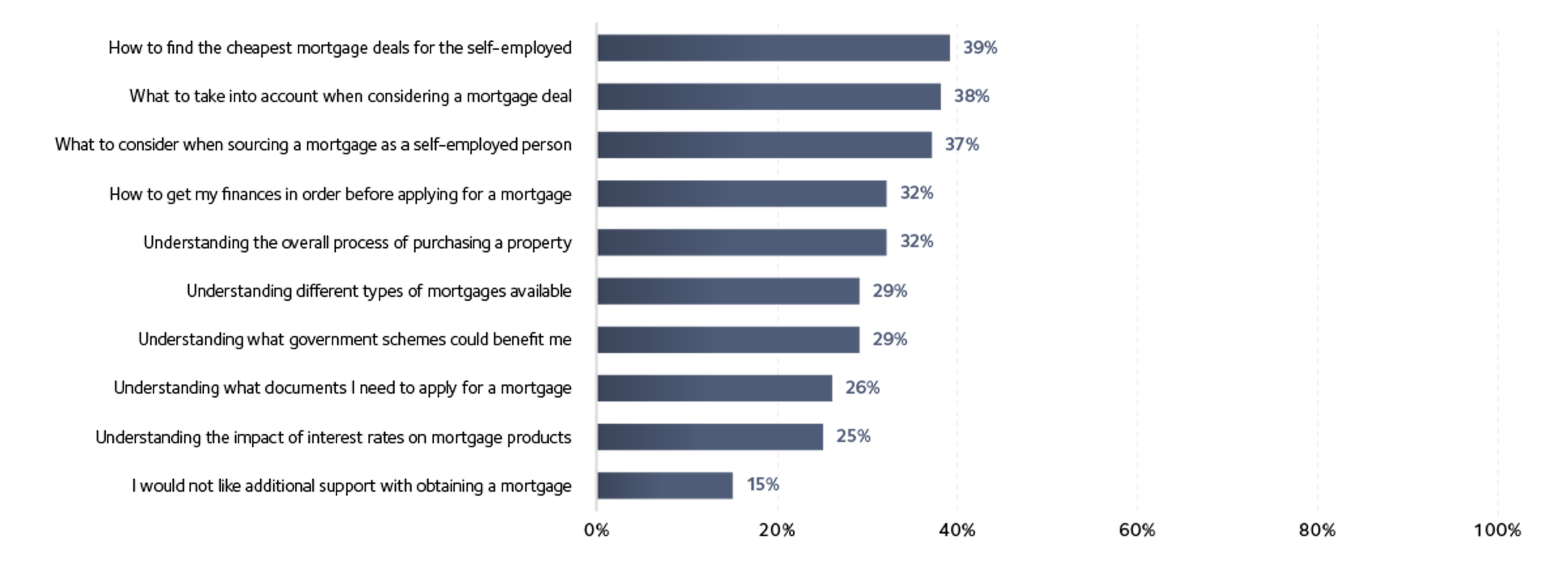

With 33 per cent of those planning to buy in the next five years not understanding the steps involved in obtaining a mortgage, it was important to understand the areas that these prospective buyers wanted greater support with.

Our research now reveals that almost two-fifths (39%) wanted further support on how to find the cheapest mortgage deals for the self-employed whilst 38 per cent wanted support around what to take into account when considering a mortgage deal.

A further 37 per cent of prospective self-employed buyers wanted more support with what to consider when sourcing a mortgage as a self-employed person whilst 32 per cent wanted greater support with understanding the overall process of purchasing a property.

An additional three in ten (32%) wanted to know how to get their finances in order before applying for a mortgage.

Other responses to areas where they wanted more support included understanding the overall process of purchasing a property (32%), understanding what government schemes could benefit them (29%), understanding different types of mortgages available (29%) and understanding what documents they need to apply for a mortgage (26%).

Similarly, a quarter (25%) wanted more support with understanding the impact of interest rates on mortgage products.

Overall, it is evident that both industry, government and advice groups need to continue in their efforts to provide further support for those seeking to purchase in the near future.

Which of the following areas related to obtaining a mortgage, if any, would you like more support with?

Conclusion

Overall, it is clear that the self-employed are facing a unique crisis when attempting to access key financial products that employees – who have regular incomes and are automatically enrolled into a workplace pensions by their employer – do not.

The research reveals that inflationary pressures and the ongoing cost-of-living crisis are taking its toll on the self-employed sector, with freelancers now significantly less likely than employee counterparts to be saving into a pension whilst also encountering some barriers to mortgage lending.

Whilst it is encouraging to see that the process of obtaining a mortgage has become less burdensome for some seeking to buy a home, the self-employed continue to feel that they will be penalised purely for their employment status.

It is therefore essential that tailored advice and products are developed for the self-employed sector so that lenders can de-risk the self-employed as customers and ensure that this 4.3 million cohort are not disadvantaged in their plans for later life and home ownership.

Policy Recommendations

To alleviate the barriers preventing more self-employed individuals from engaging with these financial products, IPSE along with CMME have developed a series of policy recommendations for both government and industry:

Saving for later life

- Tweak the Lifetime ISA (LISA) to better serve older workers. Whereas higher earning freelancers are more likely to be saving into a pension due to the benefits of higher tax reliefs, basic rate self-assessment taxpayers may find more benefit from the Lifetime ISA (LISA) – but those aged 40+ are prohibited from opening one and contributions cannot be made upon turning 50.

Removing the age limit and reducing the withdrawal charge to 20% (thereby removing the penalty), would transform the LISA into a product that suitably rewards older, self-employed basic rate taxpayers and could even encourage a return to the workforce for those that have left since the pandemic.

- Government should commission a 2023 review into the state of self-employed savings, to fully understand the barriers and challenges facing this cohort in the post-pandemic economy. Pension utilisation amongst the self-employed was already far below that of employees before the pandemic began – it is now at critically low levels and shows no sign of abating in the face of inflationary pressures on the cost-of-living.

- Government should embed planning for later life into its guidelines throughout the self-employed journey. Government should consider how it can give more visibility to the importance of setting up a personal pension as early as possible in a self-employed career by revamping its guidance for those considering self-employment.

Mortgages

- Government and the mortgage industry should work together to explore tailored products and ways of making it easier for the self-employed to successfully apply for mortgages. Our research has revealed that prospective self-employed mortgage applicants want greater support with the application process, having a greater understanding of what steps are involved and how to get their finances in order.

Mortgage products for the self-employed should therefore reflect the flexibility that is required with the finances of the self-employed; being able to cover unexpected business costs and accounting for fluctuating incomes.

- Mortgage lenders should ensure that their advisers are fully trained to understand the self-employment sector and their financial situations. With 23 per cent of respondents reporting that the process of applying for a mortgage was confusing and 88 per cent reporting that they had to provide more paperwork due to being self-employed, mortgage advisers need to be better equipped to understand and deal with the self-employed.

- Both government and the mortgage industry need to provide clear advice, support and options for those concerned about the conclusion of their fixed-term mortgage period.

Appendix

Looking for more resources?

In today's dynamic economic landscape, self-employed individuals, contractors, and freelancers face a unique set of financial challenges.

HMRC’s research into the impact of IR35 reforms was woefully inadequate – surveying just 34 employment agencies on their intentions prior to the reforms. Governme...

This article explores the benefits and potential drawbacks of consolidating pensions, emphasising the importance of informed decision-making and professional advi...