Data brief: How the self-employed save for retirement

This data brief offers new national-level insights into the savings products used by the self-employed for retirement.

Savings products

Our nationally representative survey, which included only those whose main source of income is self-employment and who earn over £10,000, now reveals that 38% are currently saving into a pension. This marks a notable improvement compared to previous national estimates. According to the Office for National Statistics (ONS), only 20% of self-employed individuals were saving into a pension between April 2018 and March 2020.4

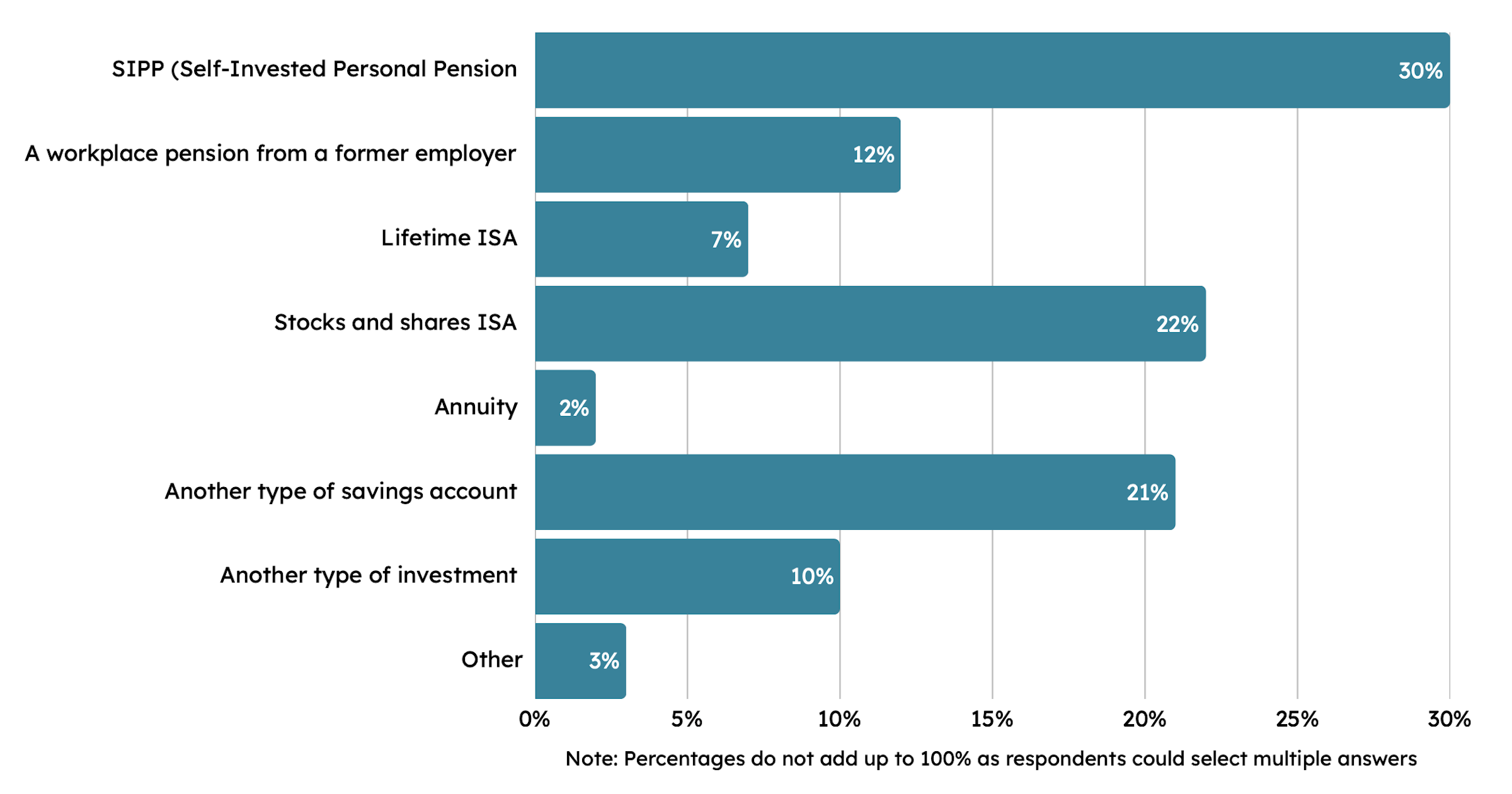

Among those saving, Self-Invested Personal Pensions (SIPPs) are the most commonly used product, with 30% of the self-employed opting for this flexible, self-managed option. This reflects a continued preference for autonomy in financial planning.

Other popular vehicles include Stocks and Shares ISAs (22%) and other savings accounts (21%), which may appeal due to their accessibility and perceived control, though they lack the tax advantages of pension-specific products.

12% of respondents still contribute to a workplace pension from a former employer, indicating some continuity in saving habits post-employment. Meanwhile, seven per cent use a Lifetime ISA, and one in ten (10%) invest through other types of investment vehicles. A small proportion also reported saving via annuities (2%) or other methods (3%).

These findings highlight the diversity of saving strategies among the self-employed, but also underscore the need for clearer guidance and support to encourage pension-specific saving.

How the self-employed save for later life

Proportion of income saved

Of those currently saving for retirement, the majority are saving relatively modest amounts towards retirement.

Nearly one-third (30%) of respondents reported saving up to five per cent of their income, while a further 22% are putting aside between six and 10%. Taken together, over half (52%) of those currently saving for retirement are contributing no more than 10% of their income.

Only a small proportion are saving at higher levels: 11% contribute between 11% and 15%, just under one in ten (8%) between 16% and 20%, and just 12% save more than 20% of their income.

Notably, six per cent of respondents are saving more than 40%, indicating a small but significant group with a strong focus on retirement planning.

Concerningly, 17% of respondents indicated that they "don’t know" what proportion of their income they are saving, suggesting a lack of clarity or engagement with retirement saving among a notable minority.

Proportion of income saved by the self-employed towards retirement

The latest self-employed news & opinions

We review the top traits the self-employed look for in their clients, based on research.

This article debunks common myths about Making Tax Digital for Income Tax and explains what the April 2026 changes will actually mean for sole traders.

Are Generation Z really behind a side hustle boom, or is it all hype? After digging into the latest data, IPSE's Fred Hicks has the answer.