How often should freelancers pay their taxes?

We examined the views of the self-employed to the government proposals to pay tax more frequently and of moving from retrospective to in-year tax.

Executive Summary

- Nearly two-thirds of freelancers (63%) oppose the idea of paying Corporation Tax more frequently

- Over half of freelancers (57%) oppose the idea of paying Income Tax more frequently

- Nearly three quarters of freelancers (72%) would struggle with increased admin burden if they had to pay income tax more frequently

- 2 out of 5 freelancers (40%) said paying taxes more frequently would cause cashflow problems

Over two-thirds of freelancers (69%) oppose a move to in-year Income Tax calculation while three-quarters (76%) oppose this for Corporation Tax

Overall, freelancers are largely opposed to increasing the frequency of either Income or Corporation Tax payments. They also even more strongly oppose the idea of moving to in-year instead of retrospective calculations for either tax.

Almost two-thirds of freelancers (63%) were either quite concerned or very concerned by the idea of increasing the frequency of Corporation Tax payments. Over half (57%) felt the same about Income Tax.

Some freelancers could see advantages to more frequent tax payments. Almost a third (32%) said they believed paying tax more frequently would be less stressful, while another 30 per cent thought it would help with budgeting throughout the year. A fifth (20%) also thought it would reduce the risk of incurring HMRC penalties and interest because of missing deadlines.

Overall, however, the proportion who saw advantages was far outweighed by those who feared it would cause serious challenges for them. Just one in ten (12%) did not think increasing the frequency of tax payments would entail any challenges for them. Meanwhile, nearly three-quarters (72%) believed paying tax more frequently would increase the administrative/time burden involved.

Freelancers also worried that increasing the frequency of tax payments could leave them out of pocket. Two out of five (40%) believed it would cause difficulties with their cashflow, while another two-fifths (39%) said they would be less able to cover unexpected costs and a third (34%) were concerned they would be more at risk of incurring HMRC/interest charges.

A quarter (24%) were concerned they would not be able to accrue interest on the funds due for tax (which they can currently invest in their business). Overall, while three-quarters of freelancers (75%) said they had money set aside for their tax payments, a fifth (19%) said they were using the money to cover their business expenses, approximately one in six (17%) had it invested in their business and one in ten (11%) were using it to cover personal bills and expenses.

Freelancers were also overwhelmingly opposed to the idea of tax being calculated in-year instead of retrospectively. Over two-thirds (69%) were either fairly or very concerned about the idea of doing this for Income Tax, which rose to over three-quarters (76%) for Corporation Tax.

Introduction

The tax system remains exceedingly complex for the self-employed. Income and Corporation Tax are paid at varying frequencies – usually once or twice a year, sometimes more frequently – and calculated from differing sources and periods depending on business structure.

As part of its modern tax administration strategy, the government is calling for evidence on a proposal to make the payment of Income Tax and Corporation Tax more frequent.1

This report explores self-employed people’s views about this proposal, the possibility of moving from retrospective to in-year calculations, as well as the benefits and challenges of the current system.

The current payment timings

At present, freelancers are required to pay Income and Corporation Tax – depending on business structure – either annually, twice a year or more frequently. Our research shows that, currently, 44 per cent of freelancers pay Income Tax once a year while 39 per cent pay twice a year and 14 per cent pay more than twice a year.

Perhaps unsurprisingly, given that limited company directors usually pay Income Tax on trading profits and Corporation Tax on annual profits, our research finds that they were more likely than sole traders to pay Income Tax more frequently: 16 per cent pay more than twice a year compared to just 4 per cent of sole traders.

To understand how freelancers felt about the current system, we asked respondents to indicate the advantages and disadvantages of the current Income Tax and Corporation Tax payment timings.

Income Tax

Two thirds (66%) of freelancers reported that a key advantage of the current Income Tax payment timings was that it reduced the administrative and time burden. Over half (54%) also said that it allowed them to manage income and cashflow fluctuations and just over a quarter (28%) agreed that it allowed them to cover unexpected costs.

Another advantage of the current system is that it allows freelancers to invest money either in their business (21%) or in other places (13%). One in five (20%) also said they were able to accrue interest on the funds that would become due as tax.

Freelancers also said that the current payment times allow them to keep accountancy costs to a minimum and ensure that payments are based on actual profits rather than on forecasts.

On the other hand, 15 per cent stated that there were no benefits to the current payment timings.

Advantages of the current income tax payment timings

Looking at the disadvantages, over one in three freelancers (37%) reported that it fails to account for current working status. For example, contractors may find themselves in between contracts when they have to find the sum to pay the tax bill.

Limited company directors (38%) were more likely than sole traders (29%) to cite the failure to account for current working status as a disadvantage.

Almost a quarter (23%) of freelancers also reported that the current payment timings make it difficult to budget throughout the year or increased the risk of getting into debt.

Concerningly, 19 per cent indicated that raising funds to pay under the current timing system creates anxiety and or stress – particularly for those who pay infrequently or often have to find significant sums to cover their tax bill.

15 per cent of freelancers also said the current timing system created an administrative burden for them, with accountancy and bookkeeping over long periods proving burdensome.

Respondents also said that ‘payment on account’ can be difficult to manage and that the current dates (particularly, for some freelancers, paying in January) can be problematic.

However, 41 per cent of freelancers reported no disadvantages to the current payment timings, suggesting that they work for many self-employed businesses.

Disadvantages to the current income tax payment timings

Looking at the disadvantages, over one in three freelancers (37%) reported that it fails to account for current working status. For example, contractors may find themselves in between contracts when they have to find the sum to pay the tax bill.

Limited company directors (38%) were more likely than sole traders (29%) to cite the failure to account for current working status as a disadvantage.

Almost a quarter (23%) of freelancers also reported that the current payment timings make it difficult to budget throughout the year or increased the risk of getting into debt.

Concerningly, 19 per cent indicated that raising funds to pay under the current timing system creates anxiety and or stress – particularly for those who pay infrequently or often have to find significant sums to cover their tax bill.

15 per cent of freelancers also said the current timing system created an administrative burden for them, with accountancy and bookkeeping over long periods proving burdensome.

Respondents also said that ‘payment on account’ can be difficult to manage and that the current dates (particularly, for some freelancers, paying in January) can be problematic.

However, 41 per cent of freelancers reported no disadvantages to the current payment timings, suggesting that they work for many self-employed businesses.

Disadvantages to the current income tax payment timings

In order to understand the implications of increasing the frequency of tax payments, it was also important to explore what freelancers currently do with the funds that would eventually become due as tax on income.

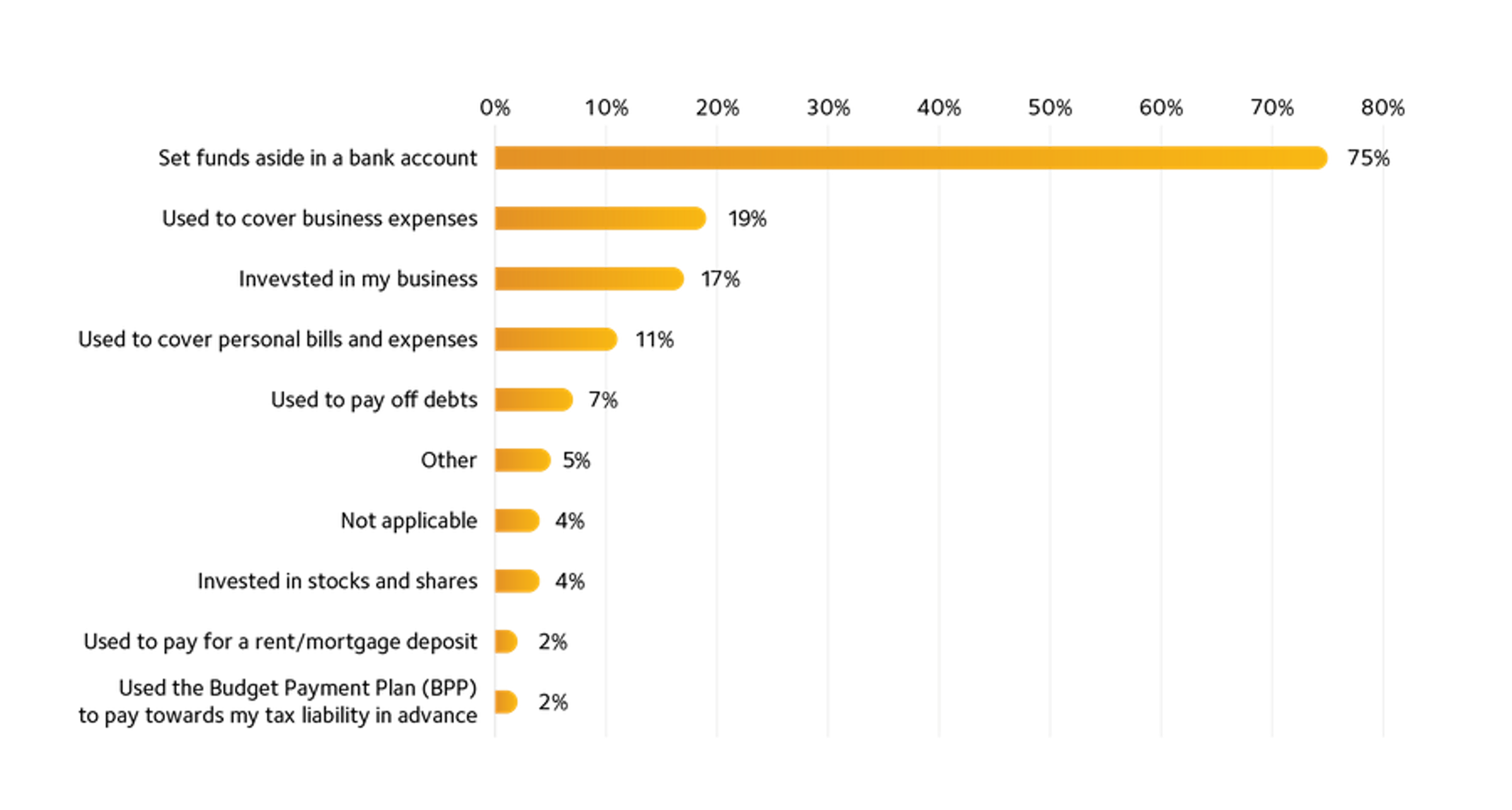

When asked what they were currently doing with the funds due as tax on income for 2020-21, the overwhelming majority of freelancers (75%) indicated that they had set the funds aside in a bank account. Just under one in five (19%) had used them to cover business expenses and 17 per cent reported that they were invested in their business.

Concerningly, one in ten (11%) had, instead, used the funds to cover personal bills and expenses and seven per cent had used the money to pay off debts. This is particularly worrying as it tallies with previous IPSE research, which shows that an increase in late payments during the pandemic has left almost one in six freelancers (15%) with no money to cover basic living expenses.2 Our Freelancer Confidence Index, a quarterly measurement of the sector, has also shown that over a quarter (27%) of freelancers are now incurring business debt.3

A further four per cent of freelancers had invested the funds in stocks and shares while two per cent had used the tax due to pay for a rent/mortgage deposit.

Just two per cent of freelancers had made use of HMRC’s Budget Payment Plan (BPP) to pay towards their tax liability in advance.

Use of funds that will become due as a tax on income for the 2020-21 tax period

Paying tax more frequently

Income Tax

Over half (57%) of freelancers reported that they were either fairly or very concerned about the proposals to pay Income Tax more frequently. A quarter (26%) of freelancers, however, were not concerned and a further 17 per cent remained neutral about the idea of paying Income Tax more frequently.

Given the choice, freelancers were more likely to want to pay annually than any other frequency: 45 per cent said this was their preferred frequency.

One in five (20%) freelancers would prefer to pay quarterly, while one in six (16%) would rather pay twice a year and a further one in six (16%) would rather pay monthly.

Interestingly, limited company directors were more likely than sole traders to prefer paying Income Tax annually (47% compared to 38% respectively), while sole traders were more likely to prefer paying twice a year (26% compared to 14% respectively).

Corporation Tax

The majority of freelancers (63%) said they were either fairly or very concerned by the proposals to pay Corporation Tax more frequently. Again, almost a quarter (22%) of freelancers were not concerned and a further 14 per cent were neutral on the idea of paying Corporation Tax more frequently.

Given the choice, freelancers were much more likely to want to pay Corporation Tax annually than any other frequency, with the majority (66%) indicating this preference. Again, this suggests that freelancers broadly prefer the current timing system to any other proposed alternatives.

Almost one in five (18%) freelancers would prefer to pay quarterly compared to other preferences such as twice a year (7%) and monthly (7%).

Advantages and disadvantages of paying tax more frequently

Almost a third of freelancers (32%) believed paying tax more frequently would be less stressful, while a further 30 per cent said that it would help with budgeting throughout the year.

Interestingly, sole traders (42%) were more likely than limited company directors (30%) to believe that more frequent payments would reduce the stress of paying a large tax bill.

One in five (20%) freelancers also expected that paying tax more frequently would reduce the risk of incurring HMRC penalties/interest charges, while 18 per cent, believed that it would reduce the risk of incurring debt.

A further 15 per cent anticipated that they would be more likely to have the funds to pay if the timings were more frequent, while five per cent predicted a reduction in the administrative/time burden of taxes.

However, over half (54%) of freelancers stated that they did not envisage any benefits to paying tax more frequently. Therefore, the majority of self-employed people do not see an advantage to increasing the frequency of tax payments. Limited company directors (56%) were also more likely than sole traders (44%) to state that there were no benefits to paying tax more frequently.

Benefits anticipated from paying tax more frequently

The overwhelming majority (72%) believed that paying taxes more frequently would increase the administrative/time burden involved.

In addition, 40 per cent of freelancers predicted difficulties with their cashflow, while 39 per cent said they would be less able to cover unexpected costs and 34 per cent were concerned they would be more at risk of incurring HMRC/interest charges.

Interestingly, sole traders were more concerned about difficulties with cashflow (47%) and the inability to cover unexpected costs (47%) compared to limited company directors (38% for both).

A further 24 per cent were also worried about not being able to accrue interest on the funds due as tax during the tax period and one in five (20%) believed that it could lead to a reduction in investment/growth opportunities. 14 per cent of freelancers also anticipated difficulties paying creditors or purchasing goods or services.

Respondents said that paying more frequently would also further complicate tax calculations and could lead to additional accounting fees.

Only 12 per cent of freelancers said that they did not envisage any challenges from paying tax more frequently.

Challenges anticipated from paying tax more frequently

Moving from retrospective to in-year payment

As part of their proposals, the government is also considering moving from retrospective to in-year tax calculations. In this next section, we explore freelancers’ responses to this idea.

A majority of freelancers (69%) said they were either fairly or very concerned by the proposed move to in-year calculations. Only 14 per cent were not concerned and a further 15 per cent were neutral about it.

Similarly, the majority (76%) of freelancers were either fairly or very concerned about moving from retrospective to in-year Corporation Tax payments. Only one in ten (10%) were not concerned and a further 12 per cent were neutral.

Overall, 62 per cent stated that they did not see any benefit to moving from retrospective to in-year payments.

There was also a clear difference between freelancers based on their business structure: 66 per cent of limited company directors saw no benefit to the proposed changes, compared to just under half of sole traders (49%).

Some freelancers, however, believed there would be benefits to in-year payments. For example, one in six freelancers (17%) anticipated that they would be more sure of their tax liability, while a further 15 per cent expected budgeting to be easier throughout the year.

13 per cent also predicted that having less time between expense and payment of tax would be good for their self-employed business, while 12 per cent felt that the switch to in-year payments could make it easier to manage tax affairs and business records.

One in ten (10%) freelancers also said the move to in-year payments would make it easier for government to calculate their entitlement to support for sudden fiscal events (such as government support for self-employed people during the pandemic).

Benefits anticipated in moving from retrospective to in-year tax payments

71 per cent of freelancers were concerned about the possibility of having to claw back overpaid tax from HMRC. Freelancers were also worried about paying too much tax up front (67%), managing payments with fluctuating income (67%) and the technology/administrative burden involved in the implementation (63%).

The challenge of managing payments with fluctuating income was more of a concern for sole traders (75%) than limited company directors (65%).

Lastly, for 38 per cent of the sample, one of the anticipated challenges was being able to accurately account for expenses.

Respondents also revealed that they were concerned about large tax bills and cashflow issues during the transition from retrospective to in-year payments if it were to be implemented.

Only six per cent of freelancers said that they did not envisage any challenges from moving to in-year payments.

Interestingly, should in-year payments be introduced, freelancers would prefer to make them based on in-year estimates (42%) compared to previous year estimates (26%); 22 per cent were also unsure what they would prefer.

Limited company directors (44%) were more likely than sole traders (33%) to prefer payments based on in-year estimates. However, sole traders (37%) were more likely than limited company directors (22%) to prefer payments based on the previous year.

Challenges anticipated in moving from retrospective to in-year tax payments

Conclusion

Overall, freelancers seem to anticipate little benefit and significant challenges arising from a move to more frequent tax deadlines – from increased administrative/time burden to fears of having to claw back overpaid tax from HMRC. In general, freelancers seem to prefer the current system by a significant margin. Limited company directors in particular seem to strongly oppose plans to increase the frequency of Corporation Tax – and worry about a hit to their cashflow and that they might not have enough set aside to cover unexpected costs. Although sole traders are somewhat less opposed to the idea of increasing the frequency of ITSA payments, they too predict the proposals would entail more challenges than benefits.

Appendix

Latest news & opinions

IPSE's Joshua Toovey argues that our political parties have lost their way when it comes to the UK's smallest businesses.

As a self-employed professional, your ability to earn an income is your most valuable asset. But what would happen if illness or injury stopped you from working –...

IPSE's Joshua Toovey outlines the top five tax tips for the self-employed so you can get ahead of next year's tax year end.