Assessing the concerns and support needs of the sector

This report examines the concerns of the self-employed sector and what support & benefits freelancers need in order to make a success of their businesses.

Executive summary

- After the experience of the pandemic, over half of freelancers (52%) do not feel supported by the government

- Two out of three freelancers (58%) want government to extend Statutory Sick Pay to them

- Half of freelancers (49%) believe that they – like employees – should be entitled to pension contributions

- More than two out of five freelancers (44%) believe they should have access to maternity and paternity pay

Two out of five freelancers (40%) now believe they should be guaranteed a minimum wage

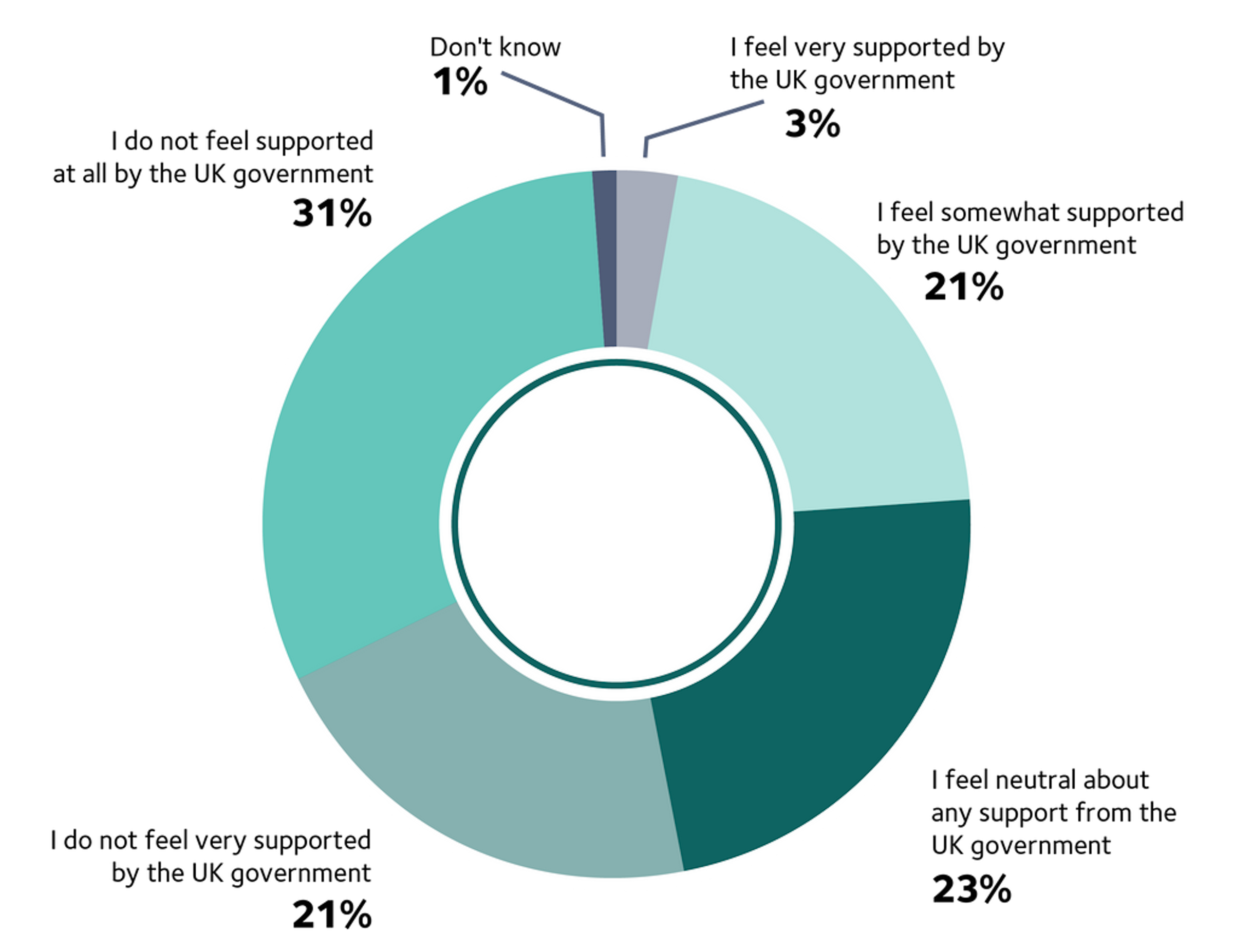

The experience of the pandemic and the gaps in support have led to more than half of freelancers (52%) not feeling supported by the government. This includes one in three (31%) of all freelancers who say they do not feel supported at all by the UK government.

The figure was even higher – 67 per cent – among limited company directors, who were not able to access the Self-Employment Income Support Scheme.

In the past, many freelancers have been uninterested in employee benefits like sick pay and pension plans, seeing the absence of these as a necessary trade-off for the freedom and flexibility of freelancing. After the financial damage of the pandemic, however, freelancers’ attitudes have shifted sharply. Two out of three freelancers (58%) now believe they should be entitled to sick pay (up from less than half before the pandemic).

Almost half of freelancers (49%) now also believe they – like employees – should be entitled to pension contributions (up from a third). More than two out of five (44%) also now believe they should be entitled to maternity and paternity pay (up from just 23%). At present freelance mothers can only claim maternity allowance and freelance fathers have no support. Two out of five freelancers (40%) now also believe they should have a guaranteed minimum wage (up from 32%).

These striking increases also reflect freelancers’ biggest concerns at present. Two thirds of freelancers (58%) are worried about the irregularity of their income. Two out of five (40%) were also concerned about not being financially prepared for retirement, while another 40 per cent worried about the blurring of the boundaries between home and work life. Almost two out of five (37%) were also worried about not being able to find new contracts and work.

Overall, it is clear freelancers are in a financially unstable and anxious position after the pandemic – and generally feel unsupported by the government. To bolster their position in the event of further lockdowns or health crises in future – and to help reconnect government with this embattled sector – IPSE is recommending the government extend Statutory Sick Pay to the self-employed.

Statutory Sick Pay for sole traders

The UK’s 3.5 million[1] sole traders are a hugely important part of the economy – it is essential that they are looked after if they fall ill and are temporarily unable to work as a result.

For sole traders, missing work through illness not only means an immediate loss of income, but it can often spell lost income in future, particularly if a client removes them from a contract as a result. With the pandemic forcing many freelancers to expend their savings and others to accumulate debt, a short period of illness – and lost income – could put the recovery of their business in jeopardy.

Unlike employees and some limited company directors, sole traders have no income safety net if they fall ill. We believe this needs to change, to ensure sole traders must no longer ‘soldier on’ through periods of illness that keep others out of the workplace.

Sole traders can apply for the Employment Support Allowance (ESA), but for shorter periods of illness, we believe a more agile and immediately available system for Statutory Sick Pay should be implemented, to bring parity between sole traders and employee sick pay entitlements.

In other parts of the world, governments do provide more generous protections for the self-employed when they fall ill. In Canada, self-employed people can claim 55 per cent of their earnings, up to a limit, if their regular weekly earnings fall by more than 40 per cent for at least a week due to illness. Similarly, the Danish system sees local authorities pay a proportion of self-employed residents’ income after two weeks of illness.

The government has demonstrated, through the Self-Employed Income Support Scheme (SEISS), that it has the competency to quickly reimburse sole traders for a loss of income.

Although SEISS was not perfect, it does serve as a blueprint for how sick pay for sole traders could work. To be eligible, sole traders would need to have submitted a tax return, meaning they have completed some work as a self-employed person; payment would then arrive within six working days. Unlike SEISS however, traders would be unable to work during the claim period, and the £50,000 threshold removed. With the rollout of Making Tax Digital, it will be even easier for the government to see who is eligible.

Introduction

IPSE’s previous research from before the onset of the pandemic, shows that the motivations for entering freelancing are overwhelmingly positive: more flexibility (88%), improved work-life balance (73%) and the freedom to choose where to work (83%) and when to work (84%).[2]

However, self-employment is not without its challenges and freelancers have previously expressed concerns over irregularity of income[3], not being financially prepared for the future[4] as well as a lack of access to statutory employment benefits.[5]

This year has been particularly challenging, with IPSE research showing that over two thirds (67%) of freelance businesses have been negatively impacted by the pandemic and associated restrictions. Falling day rates and reduced work opportunities have led to three out five (60%) freelancers experiencing a decrease in turnover with just under half of these (47%) reporting a turnover decrease of greater than 40 per cent.[6]

In response to the financial shock of the pandemic, the government did introduce a range of support packages for the self-employed, including the Self-Employment Income Support Scheme (SEISS), Bounce Back Loans and the deferment of VAT and Income Tax Self-Assessment (ITSA) payments.

However, we know that gaps in the support on offer left large sections of freelancers with little or no support, including those new to self-employment, those with annual profits of over £50,000 and limited company directors. Although some of those new to self-employment have now been included in the latest rounds of SEISS grants, limited company directors and those with annual profits over £50,000 have remained largely without support for the duration of the pandemic, leaving some unable to continue trading and others left to incur significant debt in order to survive.

Although 3.4 million self-employed people were eligible for the SEISS grants, approximately 1.6 million of the 5 million people who were self-employed at the start of the pandemic were excluded from support.[7]

Freelancers have not only suffered financially throughout the pandemic, it has also taken its toll on their mental health and wellbeing, with the number of freelancers reporting poor or very poor mental health increasing by 233 per cent since the onset of the pandemic in 2020.[8]

In an already difficult year, the April 2021 introduction of IR35 changes to the private sector have also hit limited company directors hard; in fact, as a result of the changes nearly a third (32%) are planning to stop contracting in the UK.[9]

The damage and devastation of the past year has caused the total number of self-employed to fall to approximately 4.2 million – a 14 per cent drop since the onset of the pandemic in 2020.[10] However, we know from recent IPSE research that the freedom and flexibility that self-employment offers remains highly appealing and 56 per cent of freelancers can imagine being self-employed for the rest of their lives.[11]

This report examines the current concerns of the self-employed sector and what further support and benefits freelancers need in order to make a success of their businesses. It also examines the extent to which freelancers feel supported by the UK government and concludes with a series of recommendations on how government and industry can better support the sector.

Concerns of the sector

The very nature of self-employment differs to employment, with freelancers working for themselves, contending with fluctuating incomes as well as receiving no statutory employment rights such as sick pay.

To gauge the areas where freelancers have been struggling the most throughout the pandemic, we asked freelancers which issues they had personally been concerned by over the past 12 months.

Financial concerns

The results revealed that the highest concern, with almost three in five (58%) freelancers agreeing, was the irregularity of income and unpredictable finances that often comes hand in hand with freelancing.

Interestingly, sole traders (62%) were more concerned about irregularity of income and unpredictable finances compared to limited company directors (46%).

Financial concerns also extended into financial planning for the future with two in five (40%) freelancers expressing concern about not being financially prepared for retirement. This is unsurprising given that we’ve previously found that just 31 per cent of the self-employed are saving into a pension[12] and is particularly concerning considering that more than a quarter (27%) of freelancers have burned through their savings as a result of the pandemic.[13]

Other financial areas of concern for freelancers included dealing with taxes and HMRC (35%) and not being able to access financial support, such as loans and mortgages, due to their self-employed status (30%).

This closely aligns with previous findings showing that almost three-fifths (59%) of freelancers were penalised for being self-employed when applying for a mortgage and over three quarters (77%) of freelancers who were considering applying for a mortgage were concerned it would be difficult because of their self-employed status.[14]

Late payment continues to be a concern, with almost a third (30%) of freelancers concerned by not being paid on time by a client. This echoes our previous research findings – that late payment has become increasingly more common since the beginning of the pandemic, with over third (36%) reporting that instances of late payment had increased. For those who had experienced late payment, almost a quarter (23%) had used all or most of their savings as a result.[15]

Employment benefits

Over a third (34%) of freelancers were concerned by not having access to statutory employment benefits such as maternity and paternity pay, paid holiday and sick pay.

Interestingly, sole traders were more concerned by not having access to statutory employment benefits (37%) compared to limited company directors (23%).

Over a quarter (27%) of freelancers were also concerned about not being able to take time off work due to illness, injury or for caring responsibilities. This was a particular concern for female freelancers (32%) compared to male freelancers (21%).

Government support

Over a quarter (27%) of freelancers were concerned by not being able to access government support during the pandemic.

In fact, limited company directors were more concerned than sole traders about not being able to access government support (39% compared to 24% respectively). This can be attributed to the exclusion of limited company directors from most government support schemes including the SEISS grants.

Finding work

Over a third (37%) of freelancers were concerned by not being able to find self-employed or contract work.

The difficulty in finding work can be linked to increased competition for contracts due to the reduction in the amount of work on offer as a result of the pandemic. For some, a reduction in the number of ‘outside’ IR35 contracts, due to the recent IR35 reforms, could also be a reason for increased difficulty finding work.[16]

In fact, 13 per cent now report being concerned by the introduction of changes to IR35 in the private sector and this rises to 30 per cent for limited company directors, who are more likely to be affected by the changes.

Working patterns

Looking at concerns around working patterns, two in five (40%) freelancers were concerned by the blurring of boundaries between work and home life with female freelancers especially concerned by this compared to male freelancers (47% compared to 32% respectively).

Similarly, sole traders were also more concerned by the blurring of boundaries between work and home life compared to limited company directors (43% compared to 33% respectively).

Feeling isolated and a lack of workplace socialisation was another concern for over a quarter (28%), a challenge that has been exacerbated throughout the pandemic with 24 per cent of freelancers reporting that feeling lonely and isolated had had a negative impact on their mental health.[17]

Training and the lack of access was a further concern for freelancers, with 17 per cent concerned by not having the time or money to undergo training and professional development. This is particularly concerning given that we already know that training is key to helping freelancers out of the low-pay cycle, especially for low-paid self-employed women.[18]

Unsurprisingly, given the financial devastation of the pandemic, freelancers are now most concerned about their current and future finances. Not being able to find work is also a large concern as many emerge from periods of little or no work. Furthermore, the exclusion of groups from government support during the pandemic and the introduction of IR35 reforms in the private sector have also concerned freelancers over the last 12 months.

Concerns over the last 12 months

Note: Percentages do not add up to 100% because respondents were able to select multiple responses

Support needs of the sector

There are several areas where freelancers highlighted that they would like more support which were, in the most part, linked to their key concerns.

One of the key areas where freelancers reported that they would like more support was investing and saving for later life with almost a third agreeing (29%). Interestingly, female freelancers were more likely than male freelancers to report that they wanted more support with investing and saving for later life (35% compared to 23% respectively).

With a quarter (27%) of freelancers burning through most or all of their savings to get by during the pandemic, it is more important than ever for freelancers to get greater support with saving and financial planning.[19]

Over a quarter of freelancers (27%) wanted more support with dealing with taxes and self-assessmentand 17 per cent also wanted greater support with accounting and bookkeeping.

One in five freelancers (20%) felt they would like more support finding work contracts, including help with CV’s, networking and working with agencies. This is increasingly important as we know from previous research that there continues to be increased competition from other freelancers for fewer work opportunities.[20]

Just under one in five (18%) freelancers stated that they would like to see more support with professional development, with areas such as business planning, project management and negotiation.

A further 16 per cent wanted greater support with marketing and branding whilst 13 per cent reported that they would like more support with setting, maintaining and raising rates.

Business support was another area that freelancers wanted to see greater support, with 19 per cent wanting more support with legal basics, on topics such as employment status, employment law, IR35 and contracts.

Furthermore, one in ten (10%) reported that they would like greater assistance with the practicalities ofsetting up a self-employed business whilst eight per cent wanted more support with fraud and cyber security.

An additional 13 per cent wanted more support with chasing late payments, which is unsurprising given that previous research revealed that over half (56%) of self-employed people had experienced delays in payment at some point in their career.[21]

Almost one in five (18%) also reported that they wanted greater support with mental health and wellbeing. As mentioned earlier in the report, instances of poor mental health amongst the self-employed increased by 233 per cent during the pandemic (increasing from 6 per cent reporting poor mental health to 20 per cent after the onset of the pandemic),22 highlighting a clear need for more support.

Sole traders were more likely to state that they wanted greater support with mental health and wellbeing (20%) compared to limited company directors (10%).

Unsurprisingly, given that a quarter of freelancers (27%) have burned through most or all of their savings throughout the pandemic, freelancers were most likely to want more support with saving and financial planning. Dealing with taxes and HMRC and finding work were further areas where freelancers wanted further support; no doubt exacerbated by the introduction of IR35 reforms in the private sector.

Areas that require greater support

Note: Percentages do not add up to 100% because respondents were able to select multiple responses.

Access to broadband

How often does your business suffer as a result of a lack of access to or poor coverage of broadband?

Another area that freelancers wanted more support with was being able to access good broadband coverage. The government has already committed to superfast broadband coverage for 85 per cent of the country by 2025. However, the pandemic and associated lockdown restrictions have led to unprecedented working practices, with many freelancers having to adapt to working from home full-time. We already know that prior to the pandemic, 78 per cent of freelancers reported that reliable broadband was the most important requirement for remote working, therefore it’s important that they are able to access good connection.[23]

We wanted to understand how often, if at all, freelancers and their businesses are suffering because of a lack of access to, or poor coverage of broadband.

Concerningly, seven per cent of freelancers reported that their business often suffers as a result of a lack of access to or poor coverage of broadband. A further one per cent actually reported that their business always suffers – due to a lack of access to or poor coverage of broadband – every time they try to use it – which is particularly challenging for those attempting to adapt to working from home.

Similarly, almost one in three (28%) reported that their business sometimes suffers as a result of a lack of access to or poor coverage of broadband whereas 34 per cent report that their business rarely suffers and a further 28 per cent report that their business never suffers.

With over a third (36%) of freelancers stating that their business suffers, at least sometimes, as a result of a lack of access to or poor coverage of broadband, there is clearly more that needs to be done to support the sector.

Access to employee benefits

Unlike their employee counterparts, the self-employed are not entitled to benefits such as maternity and paternity leave or pay, holiday pay and sick pay. We already know from previous research that, of those considering leaving self-employment, 35 per cent cited being able to access employment rights as a contributing factor.[24]

There are very few benefits that self-employed individuals can currently access. Female freelancers can currently claim £151.97 per week Maternity Allowance for up to 39 weeks if they are eligble,[25] however, the allowance is not income-based as maternity pay is for employees, and freelancers are unable to continue working during the time they are claiming apart from ten keep in touch days. Male freelancers, on the other hand, have no access to paternity pay or leave nor are they eligible for shared parental leave.

Looking at sick pay, whilst employees can claim Statutory Sick Pay for up to 28 weeks at £96.35 per week,[26] freelancers are not eligible for this benefit. The government has recently put in place some limited grants for individuals on low incomes who are having to self-isolate due to coronavirus, however, most freelancers remain without access to any sort of sick pay.

In the current research we examined which benefits, if any, freelancers believe they should be entitled to.

Prior to the onset of the pandemic, our survey findings revealed that 43 per cent of freelancers believed that the self-employed should be entitled to Statutory Sick Pay.[27]

Unsurprisingly, given that sickness pay has become a pressing issue during the pandemic with periods of illness and isolation leaving freelancers out of pocket, our latest research now shows that almost three-fifths (58%) of freelancers believed that the self-employed should be entitled to Statutory Sick Pay – an increase of 35 per cent since the onset of the pandemic.

In fact, female freelancers were more likely to believe the self-employed should be entitled to Statutory Sick Pay with 67 per cent reporting this compared to 48 per cent of male freelancers.

Sole traders, likewise, were more likely to believe the self-employed should be entitled to Statutory Sick Pay than limited company directors (62% compared to 48% respectively).

The second most cited benefit that freelancers felt that they should be entitled to was pension plan contributions with almost half (49%) agreeing – an increase of 40 per cent compared to our findings prior to the pandemic (35%).[28]

In terms of differences across business structure, sole traders (50%) were more likely to state that they should be entitled to pension plan contributions than limited company directors (42%).

Similarly, female freelancers were also more likely to report that they should be entitled to pension plan contributions (57%) than male freelancers (40%).

On parental rights entitlement, over two in five (44%) freelancers believed the self-employed should be entitled to maternity and paternity pay with female freelancers more likely than male freelancers to feel entitled to maternity and paternity benefits (55% compared to 32% respectively). This represents an increase of 91 per cent since 2019 when 23 per cent of freelancers felt that the self-employed should be entitled to maternity and paternity pay.[29]

In addition, 48 per cent of sole traders felt that the self-employed should be entitled to maternity and paternity pay whilst this figure fell to 31 per cent for limited company directors.

A further 30 per cent thought that the self-employed should be entitled to shared parental leave, the ability to share up to 50 weeks of leave and 37 weeks of pay in the first year of a child[30] - representing an increase of 200 per cent since 2019 (10%).[31]

In terms of employment rights, two in five (40%) freelancers believed the self-employed should be entitled to a minimum wage. Yet, there was a clear difference when looking across business structure, with 44 per cent of sole traders feeling entitled to a minimum wage compared to just 26 per cent of limited company directors.

Moreover, 35 per cent of freelancers believed the self-employed should be entitled to paid annual leavewhilst 22 per thought they should have unfair dismissal rights.

Only one fifth (18%) of freelancers did not think that the self-employed should be entitled to any employee benefits in particular.

Support for employment benefits entitlement

Note: Percentages do not add up to 100% because respondents were able to select multiple responses

Government support

The pandemic has had a devastating impact on many freelancers, with 67 per cent reporting a negative impact on their freelance businesses and 60 per cent reporting a decrease in turnover over the last 12 months. Gaps in government support left approximately 1.6 million of the 5 million people who were self-employed at the start of the pandemic excluded from support.32 This includes those new to self-employment, those with annual profits of over £50,000 and limited company directors.

While some newly self-employed people were included in the later rounds of SEISS, limited company directors and other groups continue to be excluded from support, leaving some mired in debt and others being forced out of self-employment altogether.

To understand the impact of this, we asked freelancers to what extent they felt supported by the UK government. Over half (52%) reported that they do not feel supported by the UK government, including 31 per cent reported that they do not feel supported at all by the UK government. This can be attributed to both the support gaps throughout the pandemic and also the introduction of IR35 reforms in the private sector leading to freelancers feeling they are being actively targeted by the government.

The figure rose to 67 per cent for limited company directors, who were largely unable to access government support through the pandemic compared to 48 per cent for sole traders, many of whom were able to make use of the SEISS grants. Limited company directors, in particular, were more likely to report that they do not feel supported at all, with 44 per cent reporting this compared to 27 per cent of sole traders.

A further 25 per cent felt either very or somewhat supported by the government with only three per cent feeling very supported. A total of 28 per cent of sole traders felt either very or somewhat supported compared to just 12 per cent of limited company directors, with the difference representative of support gaps.

UK Government support

Conclusion and policy recommendations

The pandemic has clearly left the freelance sector in a financially unstable, damaged position. In this unstable situation, attitudes in the sector have shifted dramatically and now many self-employed people seem less happy to sacrifice the freedom and flexibility of freelancing for the security of employee benefits. (This may also be reflected in the drop in the number of freelancers from over 5 million before the pandemic to approximately 4.2 million now).

Freelancers now feel a more urgent need for employee benefits, and of these, Statutory Sick Pay is by far the most in demand – followed by pension contributions, maternity and paternity pay and the minimum wage. The shattering financial impact of the pandemic is also reflected in the large proportion of self-employed people who do not feel supported by the UK government.

Policy Recommendations

A string of missed opportunities to support the self-employed during the pandemic has resulted in more than half of freelancers feeling they are not supported by the government. After enduring a perfect storm of repeated lockdowns, gaps in support and damaging IR35 reforms, the self-employed need support with emerging structural challenges as the dust settles after lockdown restrictions.

Unsurprisingly for an economic crisis, financial challenges are top of the list of freelancers’ concerns. But this is about more than wanting clients to pay on time and maintaining a healthy balance sheet. Engagement with financial products such as mortgages and pensions is also of particular concern to today’s freelancers, with many feeling they are at a disadvantage when it comes to buying a home or saving for later life.

The dial has also shifted on attitudes to employment benefits, with more freelancers believing that key protections like sick pay and maternity pay should not just be a preserve of those in employment, but also available to those who work alone.

If the government is to mend its relationship with the self-employed, it must now stand squarely behind those who choose to take the risk of building their own business and finding their own work – by giving itself and the self-employed workforce the tools they need to create a prosperous environment for freelancers.

1. Extend Statutory Sick Pay to the self-employed: The pandemic has highlighted the reality that freelancers are often forced to choose between their health and an income. As a result, there has been a marked shift in attitudes to sick pay among the self-employed, with 58 per cent of freelancers now in favour of being entitled to some form of sick pay.

If the government is serious about supporting the self-employed, it must make the choice between health and income a thing of the past for all forms of employment, including those who work for themselves. It should do this by utilising the SEISS framework to extend Statutory Sick Pay protections to sole traders, enabling them to claim a proportion of average earnings should their income decline due to short term illness.

2. Back the Small Business Commissioner and support tougher action on late payment: With SMEs owed an estimated £23.4bn in unpaid invoices before the pandemic hit,[33] the government must act to help unlock funds needlessly languishing in business bank accounts and put it back to work.

By establishing the office of the Small Business Commissioner, the government has moved in the right direction on late payment. But poor payment culture in the world of business is still causing a cashflow crisis for the self-employed, with 36 per cent of freelancers reporting that instances of late payment increased during the pandemic.[34]

It’s time for the government to throw its weight behind efforts to make prompt payment the norm for UK businesses, by writing the Prompt Payment Code into law and giving the Small Business Commissioner the power to issue fines and to name and shame serial late payers.

3. Business skills support for the self-employed: Our research shows that when it comes to training, core business skills – such as structuring a business, marketing and project management – are the areas freelancers need support with most. But after the financial devastation of the pandemic, many lack the cash to invest in the training they need and are locked out of tailored government initiatives such as the ‘Help to Grow’ scheme.

With swathes of freelancers now required to contract through umbrella companies following April’s IR35 changes, umbrella companies’ payrolls – and therefore their apprenticeship levy contributions – will have increased significantly. Despite these funds being earmarked for training, none of it will be spent on the freelancers generating it.

The government can put an end to this waste whilst supporting freelancers with essential business skills development by ringfencing umbrella companies’ levy contributions to create a dedicated business training fund for the self-employed.

4. Roll out the sidecar pension for the self-employed: We know from previous research that just 31 per cent of freelancers were saving into a pension before the pandemic.[35] As lockdowns forced freelancers to burn through their savings, it’s likely that self-employed engagement with pensions is even lower still.

IPSE believes the sidecar pension is freelancers’ best option and we support rolling this out to the self-employed. The sidecar enables freelancers to direct contributions into both a pension pot and a separate ‘rainy day fund’ to be drawn on in times of emergency.

An ongoing trial of the sidecar pension is now testing whether an opt-out joining mechanism will encourage more employees to save through the scheme – but this is currently open to a handful of employers. It is essential that government and industry take into account the experiences of the UK’s 4.2 million solo self-employed when testing and designing new savings products, to ensure the full benefits of the sidecar pension can be felt by people in all forms of employment.

Appendix

Latest news & opinions

IPSE's Josh Toovey explains why 2026 could bring renewed opportunity for the self-employed after a tough 2025 of limited projects and rising costs.

The festive season is a chance to celebrate another year of hard work, thank clients and colleagues, and relax after filing your tax returns for the last financia...

If you’re running a business, the festive season is often a busy time with client projects to finish, tax returns to submit, and plans to make for the following y...