The Self-Employed Landscape 2023

Our report for 2023 provides a snapshot of how the sector’s size, demographics and economic impact have changed in the past year.

Executive Summary

- The solo self-employed contributed £331 billion to the UK economy in 2023, compared to £278bn in 2022

- One in four of the solo self-employed have entered self-employment since 2020 – equating to just over 1,000,000 newly self-employed individuals

- There are now an additional 106,000 solo self-employed individuals operating in the UK compared to last year

Over two in five of the solo self-employed (42%) have been operating in this way for over ten years

Tens of thousands more over 50s are now running their own businesses despite an overall decline in self-employment since 2020, new analysis of workforce statistics shows.

The report revealed that the number of self-employed business owners aged 50 and over surged to 1.1 million in 2023 – 89,000 more than in 2020 – despite the total solo self-employed population falling by 154,000 in the same period.

Furthermore, of those aged 50 and over in self-employment, as many as one in six (15%) launched their businesses within the past three years.

Released annually, the IPSE Self-Employed Landscape report provides a snapshot of how the sector’s size, demographics and economic impact have changed in the past year.

The report also found that the sector’s economic contribution soared by more than £50bn in 2023, to a total of £331bn, after declining in 2022.

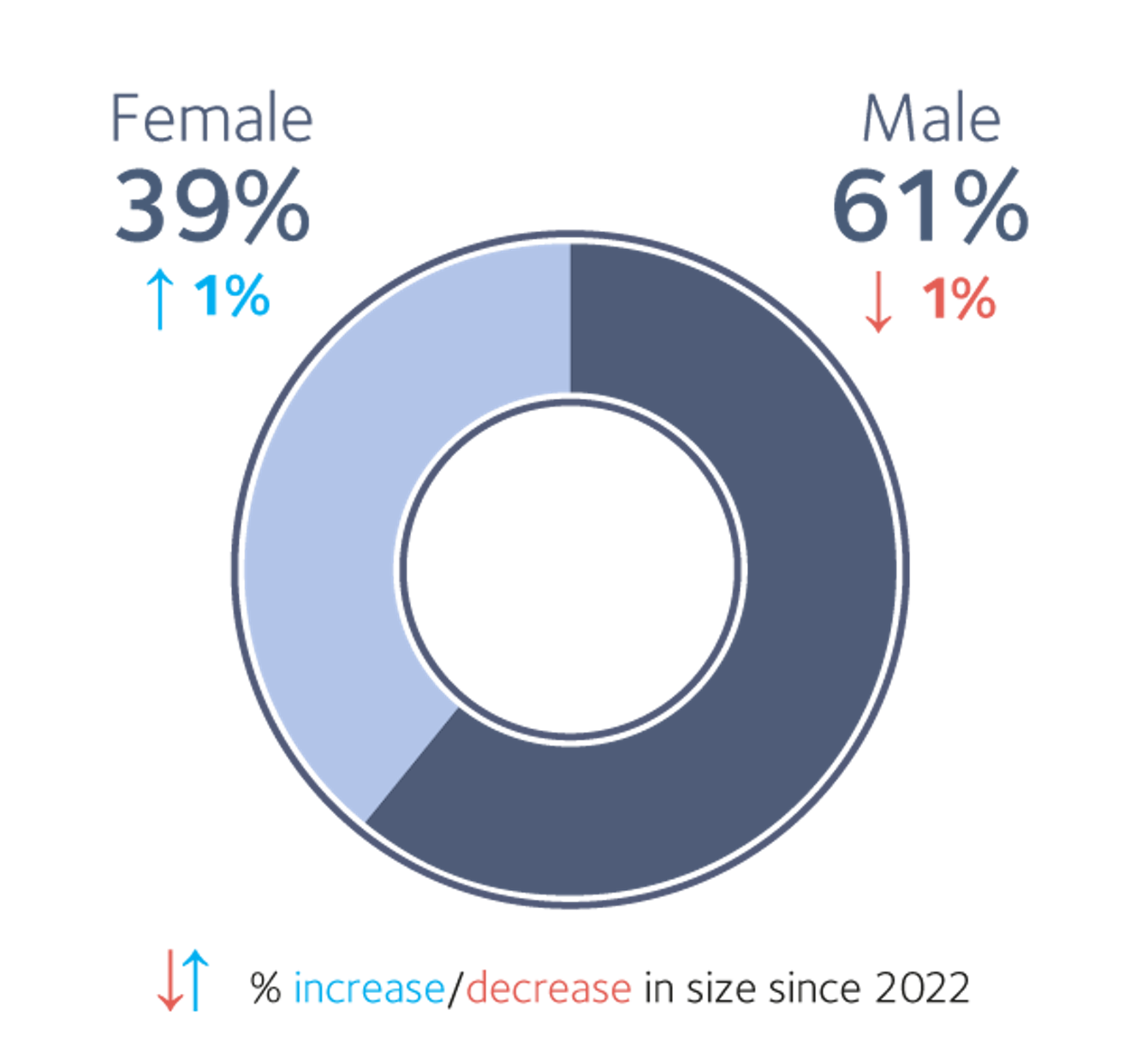

The sector continues to be predominantly male, with the gender distribution of the sector standing at 61 per cent male to 39 per cent female, with a one percentage point swing towards female in 2023. This continues a long-term trend towards more women in self-employment, which has grown by 63 per cent since 2008.

Introduction

It remains a challenging time for the self-employed population, which has struggled to mount a post-pandemic recovery and remains hampered by the imposition of the off-payroll working rules the private sector.

In fact, IPSE research has revealed that as many as one in 10 contractors (10%) are currently out of work as a direct result of the IR35 reforms.1 Furthermore, the Office for National Statistics (ONS) estimates that around 700,000 self-employed individuals have left the sector since 2020.2

Similarly, our research on the cost-of-living crisis from 2022 revealed that one in four freelancers (25%) were considering leaving self-employment in the next 12 months due to the pressures of the cost-of-living crisis.

This report examines two subsets of the overall self-employment sector: the solo self-employed – those who are self-employed but do not employ others – and freelancers – those who are working in the top three highest skill occupational categories (SOC1 to SOC3).3 From analysis of the ONS’ Labour Force Survey (LFS) data from Q2 2023, the report will review demographic changes to the sector over the last year.

The UK's Solo Self-Employed

Who are they?

In this first section, we explore the UK’s solo self-employed population in more detail using data from the second quarter of the ONS’ Labour Force Survey in 2023, 2022 and 2008. The solo self-employed are defined as individuals who are running their own business, operating as a sole trader or in a partnership and do not have any employees.

Following two successive years of relative stability in the number of solo self-employed operating in the UK – at around 4.1 million people – this year our research now reveals a small increase, with 4.2 million people operating as solo self-employed in the UK. This represents a three per cent increase on our research from 2022, with an additional 106,000 solo self-employed individuals compared to last year.

Looking ahead, this now renews hope that the sector could return to year-on-year growth, as seen between 2008 and 2019, and surpass its pre-pandemic population.

Contribution

As a result of the increase to the number of solo self-employed people now operating in the UK, the sector’s contribution to the UK economy has now increased from £278 billion in 2022 to £331 billion in 2023 – representing a 19 per cent increase.

Our estimation of the contribution to the UK economy uses the Business population estimates for the UK and regions for 20234 and the ONS’s Labour Force Survey for Q2 20235 and takes into account the total turnover of businesses with no employees.

Skill Profile

The skill profile of the UK’s solo self-employed is based on the Standard Occupational Classifications (SOCs), an internationally recognised system that classifies occupations according to the skill level required for them.6 There are currently nine major levels of SOC codes ranging from managers, directors and senior officials at the top end to elementary occupations in SOC9, which generally require a minimum level of qualifications.

Interestingly, when looking at changes in the size of SOC groups within the solo self-employed population, increases in the size of the highest skilled occupational categories have been offset by decreases in largely lower skilled occupational groups.

For instance, the number operating in SOC2 professional occupations has increased by 15 per cent since 2022, which equates to 109,000 more solo self-employed in this occupational category.

Similarly, the number in SOC3 associate professional and technical occupations has also increased by 10 per cent, whilst SOC1 managerial occupations have seen an increase of seven per cent since 2022, equivalent to an additional 70,000 and 27,000 individuals respectively.

SOC4 administrative and secretarial occupations have remained relatively stable since 2022, increasing by just one per cent in this time (equivalent to just 1,900 individuals).

On the other hand, SOC6 caring, leisure and other service occupations have seen a decrease of 20 per cent since last year, decreasing by 78,000 individuals.

In addition, SOC5 skilled trades occupations have also decreased by five per cent – equivalent to a loss of 47,000 self-employed individuals – whilst SOC8 process, plant and machine operatives decreased by six per cent (equivalent to a loss of 25,000 individuals).

Interestingly, the number operating in SOC7 sales and customer service occupations has remained the same since 2022.

Despite lower skilled occupational categories appearing to offset many of the increases found in higher skilled occupational categories over the past year, the greatest percentage increase since 2022 can be found in SOC9 elementary occupations. This has now increased by 19 per cent in the past 12 months, an increase of around 45,000 self-employed individuals.

Top Occupations

In the nine major SOC groups there are 90 minor occupational groups. Looking closely at these can give a more detailed understanding of the kinds of roles solo self-employed people are working in.

Similar to previous years, the highest proportion of the UK’s solo self-employed are working in the construction and building trades (391,000), with the total number working in this occupation increasing by nine per cent since 2022. This follows a two per cent decrease between 2021 and 2022 and a further 10 per cent reduction between 2020 and 2021.

Similarly, the next highest proportion of the UK’s solo self-employed are working as road transport drivers (281,000) or in artistic, literary and media occupations (273,000). For context, both of these occupations have remained relatively stable compared to our findings from 2022 (284,000 and 274,000 respectively).

The next occupations with the highest proportion of the UK’s solo self-employed are agricultural and related trades (191,000), elementary cleaning occupations (132,000) and teaching professionals (129,000).

Gender

The gender distribution of the UK’s solo self-employed workforce remains uneven, with more men in solo self-employment than women. The overall solo self-employed population is now 61 per cent male and 39 per cent female.

Following two successive years of the population swinging in favour of women, last year’s findings revealed that the population had swung in favour of men. This year, the population has swung in favour of women by one percentage point compared to our findings from 2022.

Overall, there was a four per cent increase in the number of solo self-employed women and a two per cent increase in the number of men.

Looking at the long-term trend reveals that the number of women has increased by 63 per cent since 2008 whilst the number of men has increased by 13 per cent over the same timeframe.

Working Mothers

There are now a total of 601,000 solo self-employed mothers, which represents a nine per cent increase on our findings from 2022. For context, solo self-employed mothers represent around 14 per cent of all solo self-employed people.

Just over half of working mothers (56%) are now working in the top three highest skilled occupations (SOC1 to SOC3).

Looking at the long-term trend, the number of working mothers has increased by 59 per cent since 2008.

Self-employed mothers are now most likely to be working in SOC2 professional occupations (148,000), SOC3 associate professional and technical occupations (144,000) and SOC6 caring, leisure and other service occupations (107,000).

Interestingly, the number of solo self-employed mothers working in SOC2 professional occupations has increased by 11 per cent since 2022.

Age

The average age of the UK’s solo self-employed is now 49 years old, which represents the second successive year where this figure has increased by one year (48 years in 2021 and 47 years in 2020).

Similar to our reports in 2019, 2020 and 2021, the largest age groups in 2023 are 50-59 years (1,161,000) and 40-49 years (933,000). When taken together, these two groups account for exactly half (50%) of the whole solo self-employed workforce.

Overall, there was a four per cent increase in the number of solo self-employed women and a two per cent increase in the number of men.

Looking at the long-term trend reveals that the number of women has increased by 63 per cent since 2008 whilst the number of men has increased by 13 per cent over the same timeframe.

Length of time in self-employment

Looking at the length of time that the UK’s solo self-employed workforce have been in self-employment reveals that 42 per cent have been working in this way for over ten years.

This represents only a small increase on our reports from 2021 and 2022 (both 41%) and also closely aligns with previous research revealing that those entering self-employment do so for overwhelmingly positive reasons7 - with this cohort clearly entering self-employment for the long run.

Interestingly, 26 per cent of the solo self-employed workforce have been in self-employment since 2020 – equating to just over 1,000,000 self-employed individuals.

In contrast, 12 per cent of the solo self-employed population have been operating in this way since 2022, equivalent to 474,000 newly self-employed individuals.

Disability

The number of solo self-employed people in the UK who are considered disabled under the Equality Act 2010 has been increasing year-on-year since 2013, increasing by 72 per cent during this time.

In fact, we know from previous IPSE research that 21 per cent of disabled people reported that they had made the move into self-employment for better work or job satisfaction.8

After a two per cent increase in the number of solo self-employed disabled in last year’s report, encouragingly, our research now reveals a six per cent increase in the number of solo self-employed disabled operating in the UK since 2022.

For comparison, the number of disabled employees has increased by 4 per cent in the same period.9

Interestingly, the age group that has seen the highest increase in the number of disabled solo self-employed since 2022 was the 30-39 years age group, increasing by 31.1 per cent during this period.

On the other hand, the over 60 years age group has decreased by 12 per cent since 2022.

Benefits

The Labour Force Survey also asks respondents to indicate whether they were claiming state benefits or tax credits during a specific one-week period in the quarter.

Looking at the data for Q2 2023 reveals that the number of solo self-employed claiming benefits has increased by seven per cent between 2022 and 2023. This follows a two per cent decrease between 2021 and 2022.

Since 2022, there has been a five per cent decrease in the number of solo self-employed people claiming pension benefits such as state pension or pension credit. For comparison, between 2021 and 2022, there was a 21 per cent increase.

In addition, just five per cent of the solo self-employed population are claiming Universal Credit in 2023 which represents the same figure as our report from 2022. This follows a decrease of 19 per cent in the number claiming Universal Credit between 2021 and 2022.

Interestingly, the number of the solo self-employed population claiming Child benefit has increased on eight per cent.

Location

The solo self-employed continue to be found in all regions of the UK, but most prominently concentrated in the South East (21%), London (17%) and the West Midlands (9%). When taken together, these areas account for almost half of the entire solo self-employed population (47%).

Interestingly, the West Midlands experienced the largest increase in overall solo self-employed numbers, increasing by 25 per cent over the last 12 months whilst the East Midlands experienced an increase of 12 per cent.

The East of England also experienced an impressive increase since last year, increasing by 17 per cent in that time.

In addition, the North West has experienced an increase of six per cent since 2022 whilst the South West has seen an increase of four per cent.

Similarly, the South East has also seen a one per cent increase to their solo self-employed population in the past year.

On the other hand, London experienced the largest decrease in its solo self-employed population, falling by seven per cent since 2022.

Northern Ireland (-3%), Scotland (-4%) and Yorkshire, (-3%) also experienced decreases in their total solo self-employed headcount in the past 12 months.

The UK's Freelance Workforce

Who are they?

Freelancers are a subsection of the solo self-employed population who are working in the top three highest skilled occupational categories (SOC1 to SOC3). This subsection includes highly skilled managers, directors, professionals and associate/technical professionals, including occupations from lawyers and accountants, doctors and scientists, to writers and designers.

There are now a total of 2,046,000 freelancers operating in the UK, an increase of 11 per cent from 2022. The number of freelancers as a proportion of the overall self-employed population is now 49 per cent. For context, our findings from 2022 revealed that freelancers accounted for 46 per cent of the overall self-employed population.

Contribution

Previous research has revealed that freelancers play a vital role in the economy by enabling businesses to manage and reduce entrepreneurial risk, enable the de-risking of uncertainties in the market and reduce the amount of finance required for innovation and business start-up; ultimately promoting innovation, enterprise and growth.10

Whilst there are no official statistics directly measuring freelancers’ contribution to the economy, it is possible to provide a speculative estimate. If freelancers’ contribution to turnover is proportionate to their presence in the wider group of businesses without employees, their collective sales would be approximately £161 billion. This would comprise 49 per cent of the £331 billion contributed by the UK’s wider solo self-employed workforce.

This figure could be even higher as freelancer-owned businesses may be expected to generate greater revenue than businesses in the lower-skilled occupational categories because of their level of knowledge and skill. Their contribution to the UK economy in 2023 could even be as high as £169 billion.

Skill profile

The largest group of freelancers, accounting for 854,000 individuals and 42 per cent of all freelancers, are those working in SOC2 professional occupations. This figure represents an increase of 14 per cent compared to our findings from 2022 and a 106 per cent increase in overall numbers working within this SOC code since 2008.

SOC3 associate and professional freelancers have experienced a 10 per cent increase in the past 12 months, now accounting for 771,000 individuals. This SOC code has experienced an increase of 23 per cent since 2008.

In addition, SOC1 managerial freelancers have also increased by six per cent over the past year, now accounting for 421,000 individuals. This represents an 18 per cent increase in the numbers operating in this SOC code since 2008.

Top Occupations

Now looking across the occupational categories in more detail reveals that occupations across the sector have been affected in different ways over the past year.

The largest occupational group for freelancers remains those operating in artistic, literary and media occupations which now account for 16 per cent of all freelancers (318,000 individuals).

Teaching professionals now account for eight per cent of all freelancers (154,000 individuals) whilst managers and proprietors in other service comprise seven per cent of all freelancers – equivalent to 151,000 individuals.

In addition, functional managers and directors represent six per cent of all freelancers which is equivalent to 126,000 freelancers.

Gender

The UK’s freelance population is now comprised of 54 per cent males and 46 per cent females, representing a one percentage point swing in favour of female freelancers since 2022. This represents a more even gender distribution than the overall UK solo self-employed population, which is 61 per cent male and 39 per cent female.

The number of highly skilled freelance men has increased by 10 per cent since 2022 – equivalent to 98,000 additional male freelancers.

Similarly, the number of highly skilled freelance women has increased by 12 per cent since 2022 – also equivalent to an additional 98,000 female freelancers.

Looking at SOC groups more closely reveals that men continue to dominate the top two highest skilled SOC groups, where they comprise 61 per cent of SOC1 managerial freelancers compared to 39 per cent of women within this SOC group.

In addition, men represent 55 per cent of SOC2 professional freelancers compared to 45 per cent of women.

Interestingly, when looking at SOC3 associate professional and technical freelancers, the gender distribution is more even, with men comprising 48 per cent and women 52 per cent.

Working mothers

There are now 336,000 highly skilled freelancing mothers in the UK, accounting for 16 per cent of the total freelancer population.

The number of freelance mothers in the UK has seen a 20 per cent increase over the last 12 months, equivalent to 56,000 additional freelance mothers.

All three SOC groups experienced an increase in the number of working mothers. SOC1 managerial freelancers experienced an increase of six per cent whilst SOC2 professional freelancers experienced an increase of 36 per cent.

In addition, SOC3 associate professional and technical freelancers experienced an increase of 11 per cent in their population of working mothers.

Age

The largest age groups for freelancers are those aged between 50-59 (582,000) and 40-49 (486,000), with these age groups comprising 28 per cent and 24 of all freelancers respectively. Combined, these age groups account for over half of all freelancers (52%).

Consequently, the average age of UK freelancers is 50 years old, which is one year older than the overall solo self-employed average age.

Interestingly, all age groups experienced an increase in their overall headcounts in the last 12 months.

The 16-29 age group experienced an increase of three per cent since 2022 whilst the 30-39 age group increased by eight per cent.

Similarly, the 40-49 age group has also increased by seven per cent whilst the 50-59 age group increased by 27 per cent.

In addition, the 60+ age group increased by three per cent since 2022.

Notably, since 2008, the number of 60+ year olds operating as freelancers has increased by 77 per cent.

Length of time in self-employment

Now looking at the length of time that the UK’s freelance workforce have been in self-employment reveals that 44 per cent have been operating in this way for over 10 years.

This represents a decrease on our findings from 2022, where 51 per cent of freelancers had been working in this way for over 10 years.

Interestingly, 54 per cent of the freelance workforce have entered self-employment since 2015.

Notably, 12 per cent of freelancers have entered self-employment since 2022.

Benefits

Since 2022, there have been large decreases in the number of freelancers claiming almost all of the benefits that we track in our landscape report (excluding state pension or pension credit).

The number of freelancers claiming Universal Credit has now increased by 23 per cent since 2022.

Similarly, the number of freelancers claiming tax credits has also increased over the last year, increasing by 12 per cent.

On the other hand, the number of freelancers claiming housing or council tax reduction has decreased by 31 per cent in the same time period.

In addition, the number of freelancers claiming sickness or disability benefits has fallen by 22.2 per cent since 2022.

The number of freelancers claiming child benefit has also increased by 18 per cent in the past 12 months.

Location

Freelancers continue to have a similar geographical distribution to the overall solo self-employed workforce. However, unlike the solo self-employed workforce, the UK's freelance workforce has experienced increases across all regions of the UK.

A significant proportion of freelancers live in London (22%) and the South East (21%) – which closely follows our findings for the overall solo self-employed (17% and 21% respectively).

The North West has seen the largest increase in its freelance population since 2022, increasing by 42 per cent whilst the East Midlands has increased by 2 per cent in the past 12 months.

Wales has experienced an increase of 22 per cent in the past year whilst the West Midlands has experienced an increase of 26 per cent in the past year.

Similarly, the South West has also experienced an increase, increasing by 14 per cent since 2022.

Conclusion

With the research revealing an increase in the overall economic contribution of the sector and an increase in the number of over 50s adopting self-employment since the pandemic, self-employment continues to provide vital support to clients, the wider economy and to those now in the prime of their careers.

It is also encouraging that the number of women taking up self-employment shows no sign of slowing, with the overall number increasing by 63 per cent since 2008 and now representing 39 per cent of all solo self-employed individuals.

Similarly, working mothers, in particular, continue to adopt self-employment for the flexibility and autonomy that it provides, with this group increasing by nine per cent since 2022.

With overall numbers in solo self-employment only slightly increasing since last year, it remains to be seen if the sector now enjoys more substantial growth and a return to record-high pre-pandemic levels.

Latest news & opinions

As the tax year draws to a close, our specialist financial advisory partner Chase de Vere summarise the key things to think about before tax year-end.

Practical tips for the self-employed to manage income volatility, grow savings, and strengthen long-term financial resilience.

New research into the financial health of the self-employed sector has found that more than 1.5 million have little cash in reserve, with many more struggling to ...