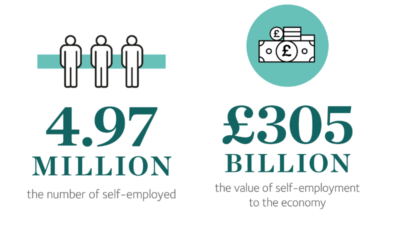

Today, one in six people working in the UK are self-employed. They are a huge and ever-growing part of our economy and our society – and this election, they must be recognised.

If parties do recognise their importance and pledge to support them, there are big potential rewards.

This election, freelancers and the self-employed represent 5 million votes up for grabs. The 2019 IPSE manifesto sets out exactly what parties need to do to secure them.

MPs and candidates: why freelancers matter

There are almost as many freelancers and self-employed in the UK today as the entire public sector and they simply cannot be ignored.

But they aren’t just a big part of the workforce: they are an enormous economic driver too. In fact, freelancers add £305bn to the UK economy every year – enough to fund the NHS twice over. Not to mention the vital flexibility and dynamism they bring to businesses across the UK.

It’s not all economics and productivity either: self-employment is also a liberating lifeline to people who might otherwise struggle with traditional employment. From new parents and older workers to people with disabilities, millions use freelancing as their flexible way into the workforce.

IPSE’s manifesto includes 40 recommendations to support the self-employed, but you can also read a summary of our top 5 policy priorities:

Build a modern tax system: Our outdated, overly complex tax system needs updating for self-employment in the 21st Century. We recommend a full, wide-ranging review of small business tax, scrapping IR35 and ending confusion over the Loan Charge to unleash the UK’s entrepreneurial spirit.

End the culture of late payment: The next government should fast-track plans to strengthen the role of the Small Business Commissioner by giving him powers to fine and ‘name and shame’ late payers. This would put an end to the time and money freelancers lose every year on chasing unpaid invoices.

Identify solutions for saving in later life: Prevent a self-employed savings crisis by working with industry to find tailored products for freelancers, such as the sidecar pension, to help them put money away for retirement.

Update freelancers’ parental rights: Extend Shared Parental Leave (SPL) to the self-employed and take action on maternity/paternity pay, so that parents have equal opportunities to care for their children – and build their own business.

Incentivise workhubs to boost the high street: Co-working spaces incubate small businesses, innovation and collaboration at the heart of communities - incentivising the use of empty premises for workhubs through exemptions in business rates could help revive Britain’s high street.

Read the manifesto

Read the pamphlet or full version of our manifesto here:

Our campaign:

#5millionvotes