IPSE has recently heard reports from our members and the wider self-employed community that HMRC is investigating and then recouping excess or wrongly claimed support payments from the SEISS and CJRS grants. On this page you can find information on what these grants are and what to do if you receive any correspondence from HMRC about your claim – or believe your claim is being investigated.

What is SEISS and what's been happening with it?

Self-Employment Income Support Scheme (SEISS) grants are payments made by government to eligible self-employed businesses that have been affected by the pandemic.

A total of 8.8 million grant payments have been claimed by a total of 2.8 million people.

First introduced in March 2020 and initially worth 80 per cent of past average monthly trading profits, the scheme has seen five grant payments, the last of which covers the five-month period from May to September 2021.

Applicants for the fifth grant were able to apply from late July through a Government Gateway account. The deadline for claims is 30 September 2021.

As with previous grants, the fifth round of SEISS is only available to sole traders. Company directors are not eligible.

This fifth grant is subject to a new turnover test and, based on this, it will pay out grants worth either 80 per cent or 30 per cent of three months’ average trading profits.

The turnover test requires an individual or business to seen have a reduction in turnover of at least 30 per cent since the beginning of the pandemic.

If you pass the test, you will be eligible for a grant payment of 80 per cent of three months’ average trading profits – up to a maximum payment of £7,500. Otherwise, the grant will be paid at 30 per cent of average trading profits, up to a maximum of £2,850.

Newly self-employed people (those who began trading in 2019-20) will not have to consider the turnover test when applying.

To learn more about the application process read our dedicated page on SEISS: How to apply for the self-employment grant.

What is furlough for Ltd companies?

First introduced in March 2020, the Coronavirus Job Retention Scheme (furlough) provided employers with a grant to cover 80 per cent of the wages of employees who are not working but kept on the payroll – up to a maximum payment of £2,500 per month.

The scheme can also be used by limited company directors who pay themselves a salary through their own limited company – or any other employees of the limited company.

Under the original CJRS, the company director (or employee) could do no work for the company. The first CJRS payment covered backdated pay from 1 March 2020.

Flexible furlough, which allowed for partial furlough and partial work, was allowed from 1 July 2020.

CJRS has now been extended until 30 September 2021 but requires a greater contribution from employers.

Since 1 August 2021, the government contributes 60 per cent of wages for the hours the employee is on furlough, up to a maximum of £1,875; employers top up employees’ wages to make sure they receive 80 per cent of their salaries.

CJRS payments are calculated on salary only: dividends are not considered. Because many company directors pay themselves largely in dividends, CJRS provides only a fraction of the income directors would likely have received were it not for the pandemic.

What are the eligibility criteria for SEISS/furlough?

The first SEISS grant payments, covering the periods March to May, June to August, and November to January, were available to people who had suffered financial losses because of the pandemic, had filed a tax return before 2019/20, and whose trading profits did not exceed £50,000.

Originally, in March 2020, CJRS payments were available to businesses that had a PAYE payroll system in place before 19 March 2020. People who had been made redundant before then could also qualify for payments if they were re-employed by their former employer.

Gaps in support

The eligibility criteria left out large sections of freelancers – including the newly self-employed, people with annual profits over £50,000 and limited company directors – with little or no support.

Although some newly self-employed were eventually included in the later SEISS grants, limited company directors and those with annual profits over £50,000 were left without support for most of the pandemic, which forced many to take on debt to keep their business afloat – and drove many others out of self-employment altogether.

Overall, while 3.4 million self-employed people were eligible for the Self-Employment Income Support Scheme, approximately 1.6 million of the 5 million people who were self-employed at the start of the pandemic were excluded from support.

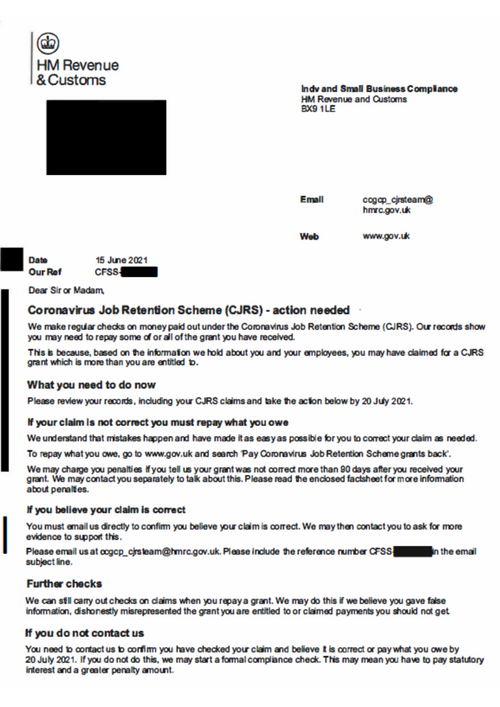

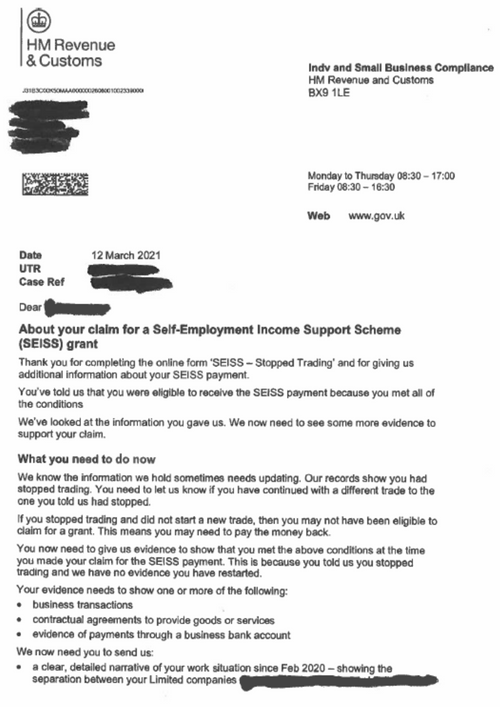

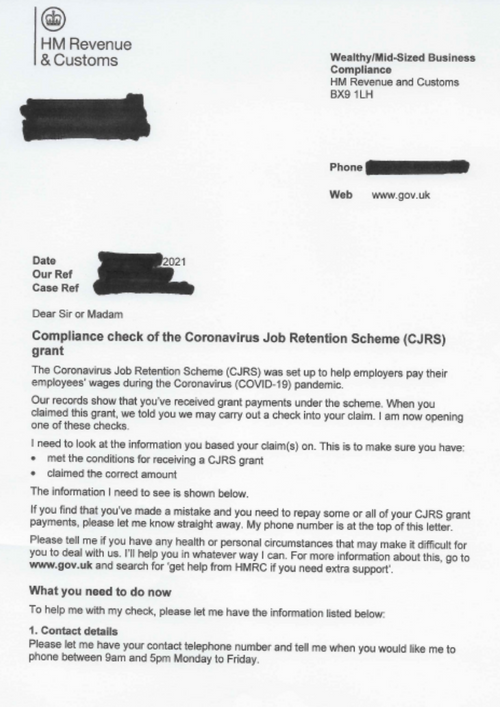

What is SEISS/furlough clawback?

SEISS/furlough clawback is the process whereby HMRC investigates and subsequently recoups excess or wrongly claimed support payments.

The new Taxpayers Protection Taskforce, supported by £100 million in investment from the Treasury and staffed by over 1,250 HMRC officials, will oversee the clawback operation. They will investigate and even prosecute people deemed to have misused or abused the government support schemes during the pandemic.

In June, it emerged that nearly 13,000 investigations into furlough and SEISS claims had already been opened by the end of March 2021. With an estimated £3.5bn in overclaimed grants expected to be clawed back from the furlough scheme alone, it is likely that thousands more investigations will be opened in the years ahead.

HMRC is also able to launch investigations into SEISS and CJRS claims for up to five years after the claims were made, so we expect this to remain a concern for self-employed people for some time to come.

The question of whether the self-employed should be wary of investigations into their use of financial support rests largely on HMRC’s approach to honest but erroneous claims.

Guidance on claiming government support payments was often complex, leaving open the possibility that some of the self-employed claimed money with a genuine belief they were entitled to it, without realising HMRC might hold a different view.

If HMRC open a formal enquiry into your SEISS or furlough claim, putting up a defence can be costly and time-consuming – which is why securing cover against HMRC compliance checks can give you peace of mind.

In addition to reviewing government support claims for misuse or abuse, HMRC can also launch various forms of investigation into your tax affairs, including PAYE and VAT reviews and requests for extensive information to check your accounts, calculations and self-assessment tax returns.

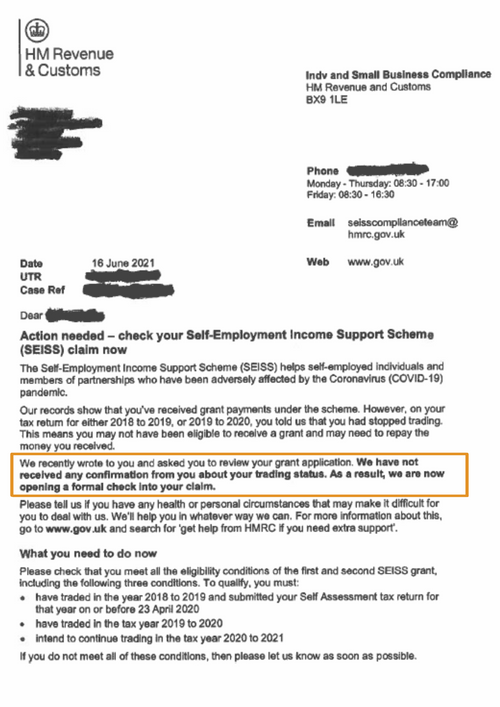

Understanding nudge letters and investigations

What happens if HMRC opens a claim against me?

If you are an IPSE member and you receive any communication from HMRC that you are unsure about or causes you concern, please don’t hesitate to contact the tax advice helpline.

If you are an IPSE Plus member and you believe the communication you have received is a compliance check, we encourage you to contact IPSE so that we can make a claim on the IPSE tax investigation insurance policy which supports this important membership benefit. It is better to make a claim and have it turned down because it isn’t an insured event (e.g. a nudge letter), than not to make the claim and miss out on the benefit and expert representation.

When HMRC investigate your work, they will send you an initial notification. IPSE Plus members are covered from this point, and IPSE will draft a response to the initial notification from HMRC, removing the stress and minimising the risk of responding incorrectly. If HMRC want to proceed with the check, IPSE will represent you at no cost.

Should this then be escalated to a formal dispute, IPSE Standard members can then submit a claim (the original claim will continue for Plus members) and will be assigned a specialist who will handle all correspondence with HMRC at no cost to you. IPSE members can also receive up to £250 per day compensation for loss of earnings for tax compliance meetings (subject to a maximum of £750 and as long as the member’s attendance was requested by the Markel Tax consultant), as per your contract at the time.

Once you are aware that a claim needs to be made, the next stages for a tax claim are as follows:

- Complete the relevant section on the claim form and submit to IPSE with the requisite attachments

- This form will then be passed on to Markel Tax

- You will then be notified of acceptance

- You will be contacted by an investigations consultant and will be asked to sign a letter authorising Markel Tax to act in the enquiry

- The consultant will work with you until the enquiry is resolved

- There will be no fees to pay, but VAT registered members who are not on the Flat Rate scheme will need to pay the VAT element of the Markel Tax fees and reclaim the VAT as part of their VAT return

- At the conclusion of the enquiry, you will be asked to complete a feedback form as Markel and IPSE would like to hear how you felt the matter went and any ways we can improve the process for our members.

Read about how an unnamed IPSE member was targeted by a HMRC nudge letter

How can I protect myself against an investigation?

With IPSE Plus membership, you are covered against any compliance checks made by HMRC into claims and payments made through both the SEISS and furlough schemes.

If HMRC challenge your eligibility to receive the SEISS and CJRS grant payments and/or the amounts claimed, you will be protected by the cover if HMRC’s opinion or assessment can be challenged.

A Markel Tax specialist tax investigation consultant would then deal with the compliance checks and challenge on your behalf, with defence costs covered as part of IPSE membership.

However, where HMRC can successfully argue that a claimant was ineligible, or where they have correctly assessed any amounts due, protection against SEISS and furlough clawback would cease.

This protection covers the opening of an official HMRC compliance check into SEISS and CJRS claims and/or payments and not upon receiving a ‘nudge’ letter.

IPSE members can also receive up to £250 per day compensation for loss of earnings for tax compliance meetings (subject to a maximum of £750 and as long as the member’s attendance was requested by the Markel Tax consultant), as per your contract at the time.

Learn more about this and other benefits of IPSE membership.

Alternatively, you can contact IPSE’s membership team: [email protected]

Tell us if your claim is under investigation

If you or somebody you know has experienced HMRC enquiries into SEISS or CJRS grants, we encourage you to get in touch and make us aware of your case:

Press Office: [email protected]

Policy Queries: [email protected]

Looking for more advice? We can help.

We have a dedicated advice page to help you navigate directly to specific sections including Brexit, coronavirus, business insurances, and ways of working.

View all advice pages